2 min read

• Aug. 28, 2025Affordability will drive the pace of any energy transition

- The cost of energy and essential products borne by consumers will be a critical factor in the pace of any energy transition.

- Lower-emissions solutions are generally more expensive and not affordable for many consumers, especially in developing economies with lower disposable income.

- Sustained economic growth and continued innovation to reduce costs for key technologies are essential for improving affordability.

2 min read

• Aug. 28, 2025The importance of energy affordability is increasingly recognized as a key factor to enable a sustainable pace of emissions reduction (e.g. IEA, 2024). However, there is currently no clear or consistent definition of what it means for any energy transition to be “affordable”. What we do know is that the impact on households of any increase in the cost of energy or essential energy-related goods and services is an important constraint.

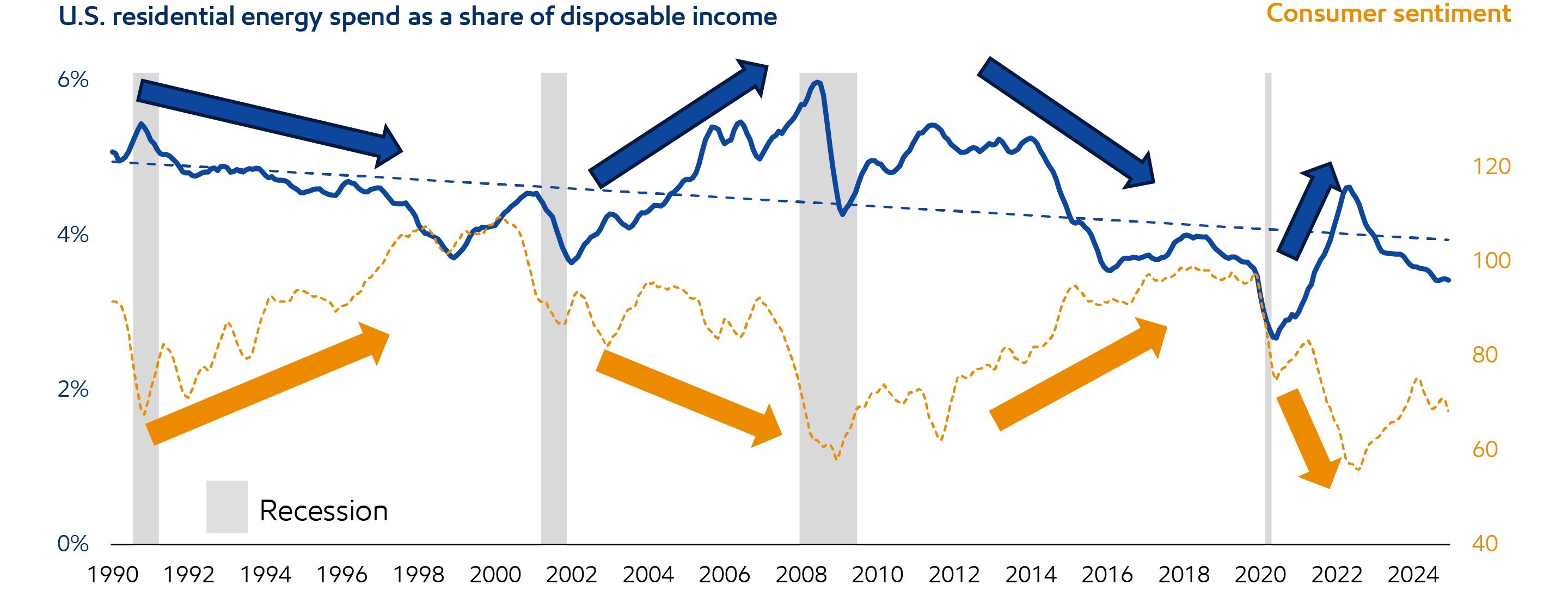

Sources: Energy share of Disposal Income from US BEA (6-mo rolling average)

Consumer sentiment from UMichigan Consumer Sentiment 1966Q1 = 100

Recessions from National Bureau of Economic Research

Our analysis indicates that consumers are highly responsive to changes in energy costs. This is demonstrated by looking at the historical relationship between energy spending as a share of disposable personal income from the Bureau of Economic Analysis and consumer confidence in the United States, as measured by the University of Michigan’s Index of consumer sentiment. Historically, when energy costs suddenly rise, consumers tend to react by spending less on other goods and services, which can hurt the broader economy. For example, sharp spikes in energy spending as a share of disposable income have preceded most postwar U.S. recessions.

However, this analysis also shows that energy expenditures as a share of household income has gradually declined in the U.S. over the past three decades (blue dashed line in figure), indicating affordability improves with economic growth. This case study highlights the importance of policies that both drive economic growth, underpinned by access to affordable energy, and reduce emissions.

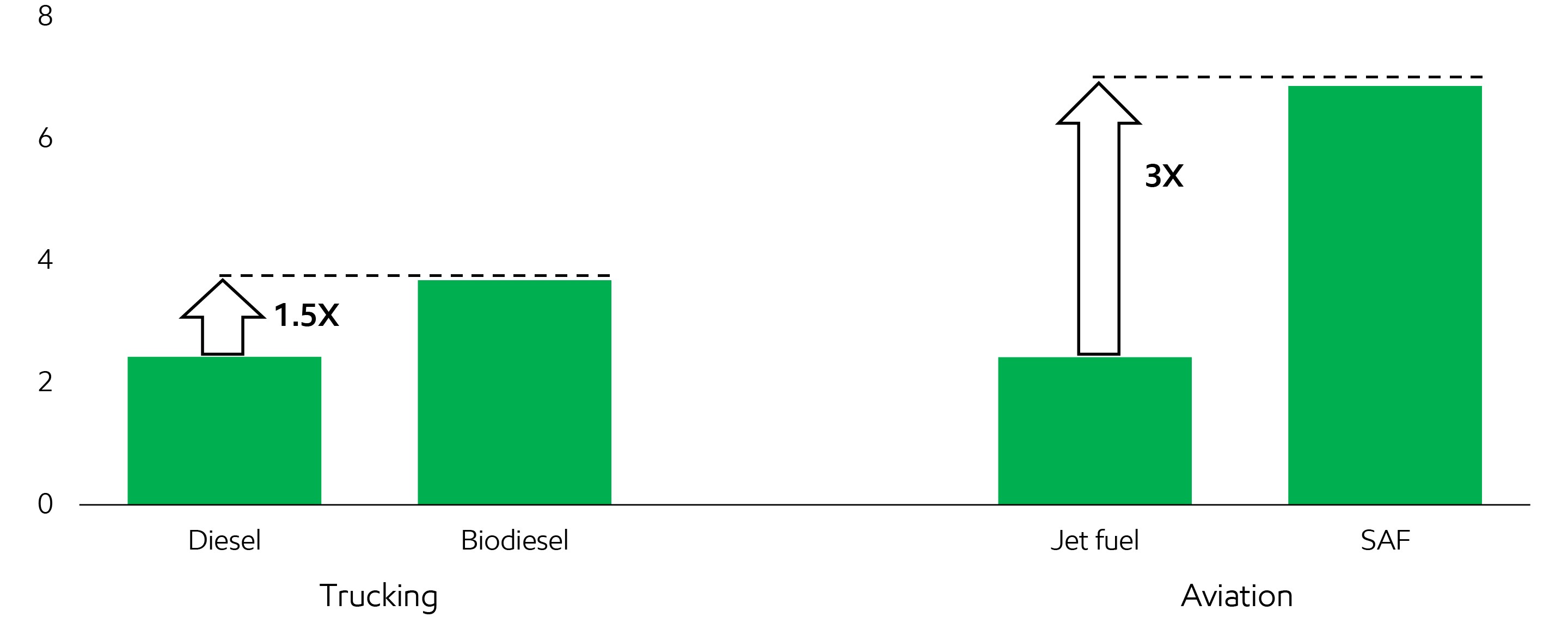

Trucking and aviation fuel prices

$ per gallon equivalent

Sources: Trucking from S&P, Aviation from European Union Aviation Safety Agency

Prices are European 2024 average

Gallon equivalent takes into account energy density differences between fuels

Affordability matters because critical abatement technologies are generally more expensive than incumbent technologies, and these incremental costs will in most cases be borne by household consumers. Take an example from transport. Today, commercial transportation makes up 15% of global energy use and emissions. However, the costs of alternative fuels for heavy-duty trucking and aviation are ~1.5-3x more expensive per unit of energy than the incumbent technology.

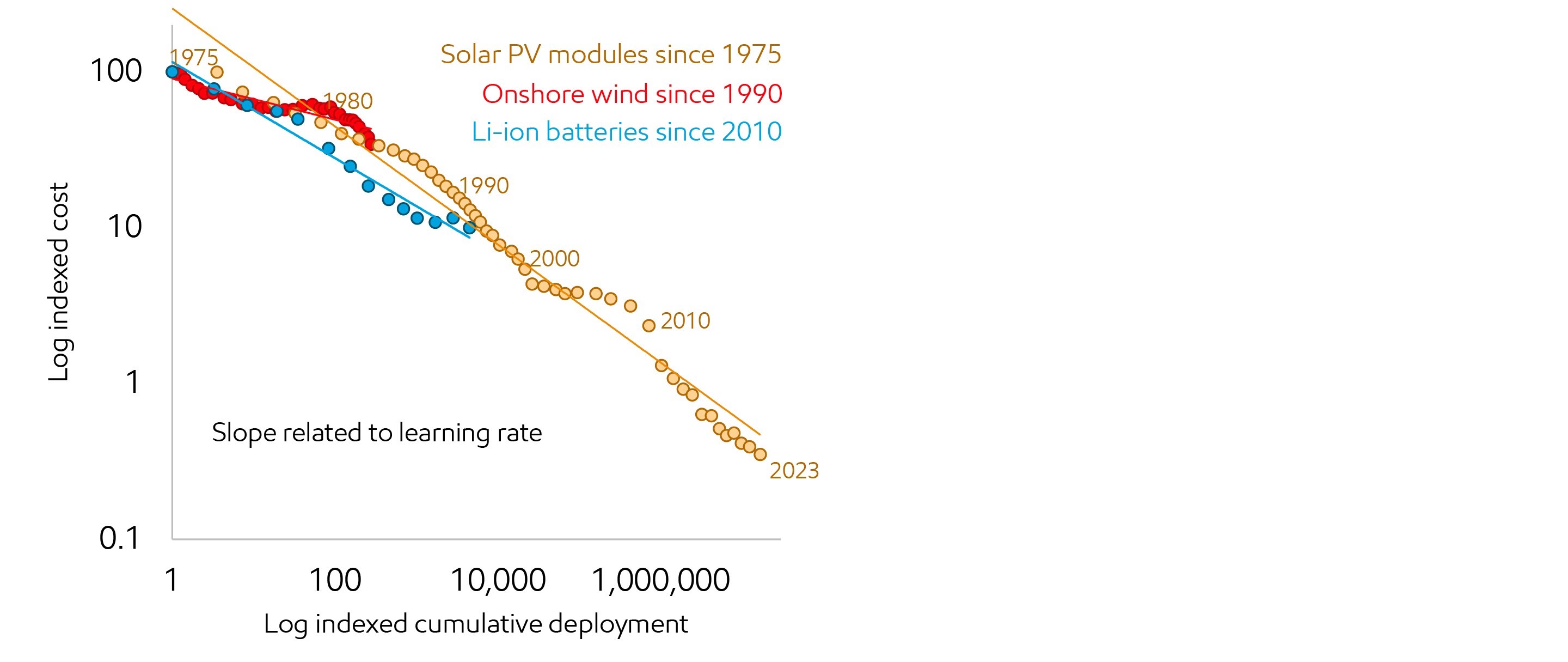

Technology costs decline with cumulative deployment

Sources: Solar deployment from BNEF Solar Tracker; Costs from IRENA Renewable Power Generation Costs in 2024; Onshore wind deployment from BNEF Wind Tracker; Costs from IRENA Renewable Power Generation Costs in 2024; Lithium-ion batteries deployment and costs from BNEF Lithium-ion Battery Price Survey (2024)

Technology costs improve over time as experience and innovation drive technological improvements. For example, in the past 25 years, solar PV module costs have declined 95%, and in the past 15 years, Lithium-ion battery costs have declined 90%.

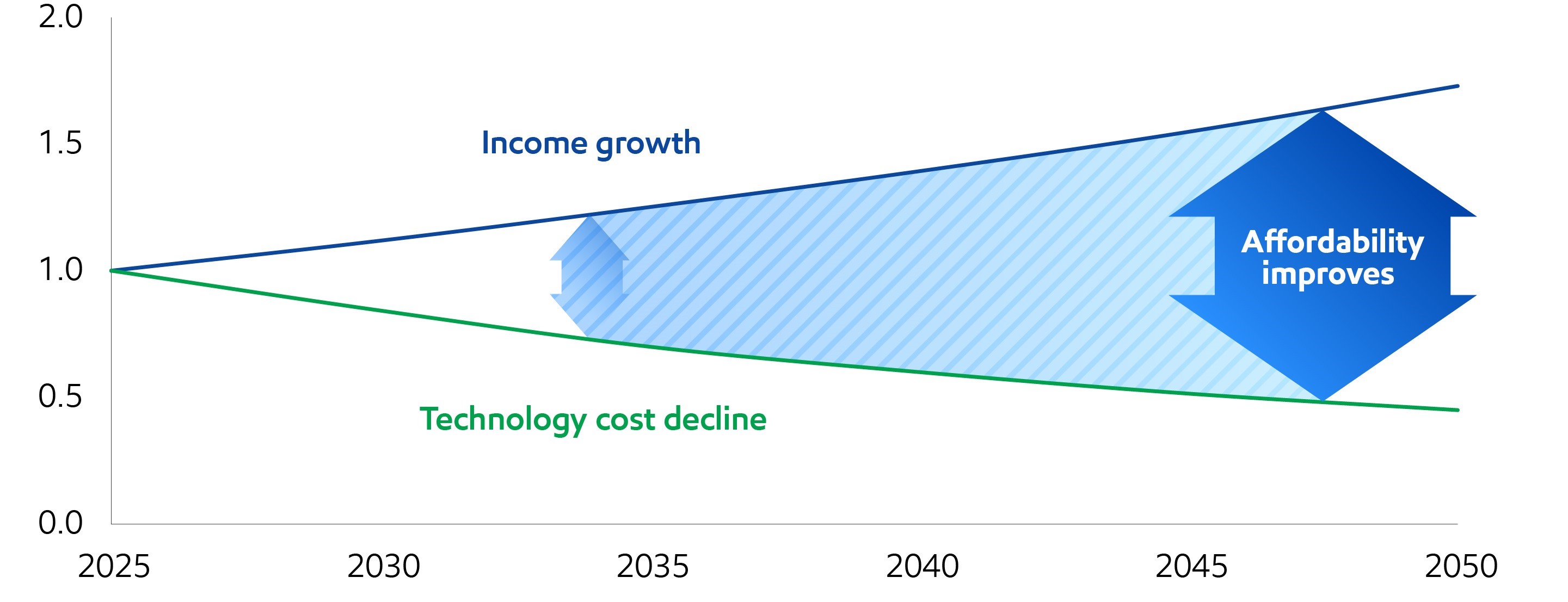

Affordability improves as income grows and technology costs decline

Income / Cost indexed to 2025 (indicative)

Illustrative technology cost based on onshore wind historical analog

Over time, the combination of growing prosperity, underpinned by access to affordable energy, and declining technology costs has the potential to lead to significant improvements in affordability. For example, our Outlook projects that global average income will grow ~80% by 2050, improving both quality of life and consumers’ ability to afford the increased costs of an energy transition. When this is coupled with declining technology costs, there is the potential for significant improvement in the affordability of an energy transition.

-

CO2 emissions projected to fall 25% by 2050, but more progress is needed

Learn more- Efficiency improvements and renewables are necessary but not a complete solution.

- Technologies like hydrogen, carbon capture and storage, and biofuels have yet to reach their full potential but are needed to reduce emissions on a global scale.

-

All energy types will be needed

Under any credible scenario, oil and gas remain essential.Learn more

Global Outlook

Explore more

Cautionary statement

The Global Outlook includes Exxon Mobil Corporation’s internal estimates of both historical levels and projections of challenging topics such as global energy demand, supply, and trends through 2050 based upon internal data and analyses as well as publicly available information from many external sources including the International Energy Agency. Separate from ExxonMobil’s analysis, we discuss a number of third-party scenarios such as the Intergovernmental Panel on Climate Change Likely Below 2°C and the International Energy Agency scenarios. Third-party scenarios discussed in this report reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use and inclusion herein is not an endorsement by ExxonMobil of their results, likelihood or probability. Work on the Outlook and report was conducted during 2024 and 2025. The report contains forward-looking statements, including projections, targets, expectations, estimates and assumptions of future behaviors. Actual future conditions and results (including but not limited to energy demand, energy supply, the growth of energy demand and supply, the impact of new technologies, the relative mix of energy across sources, economic sectors and geographic regions, imports and exports of energy, emissions and plans to reduce emissions) could differ materially due to changes in a number of factors, including: economic conditions, the ability to scale new technologies on a cost-effective basis, unexpected technological developments, the development of new supply sources, changes in law or government policy, political events, demographic changes and migration patterns, trade patterns, the development and enforcement of global, regional or national mandates, changes in consumer preferences, war, civil unrest, and other political or security disturbances, including disruption of land or sea transportation routes; decoupling of economies, realignment of global trade and supply chain networks, and disruptions in military alliances and other factors discussed herein and under the heading “Factors Affecting Future Results” in the Investors section of our website at Exxon Mobil Corporation | ExxonMobil

The Outlook was published in August 2025. ExxonMobil assumes no duty to update these statements or materials as of any future date, and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of this material as of any future date. The Global Outlook is a voluntary disclosure and are not designed to fulfill any U.S., foreign, or third-party required reporting framework. This material is not to be used or reproduced without the express written permission of Exxon Mobil Corporation. All rights reserved.