4 min read

• Aug. 28, 2025All energy types will be needed

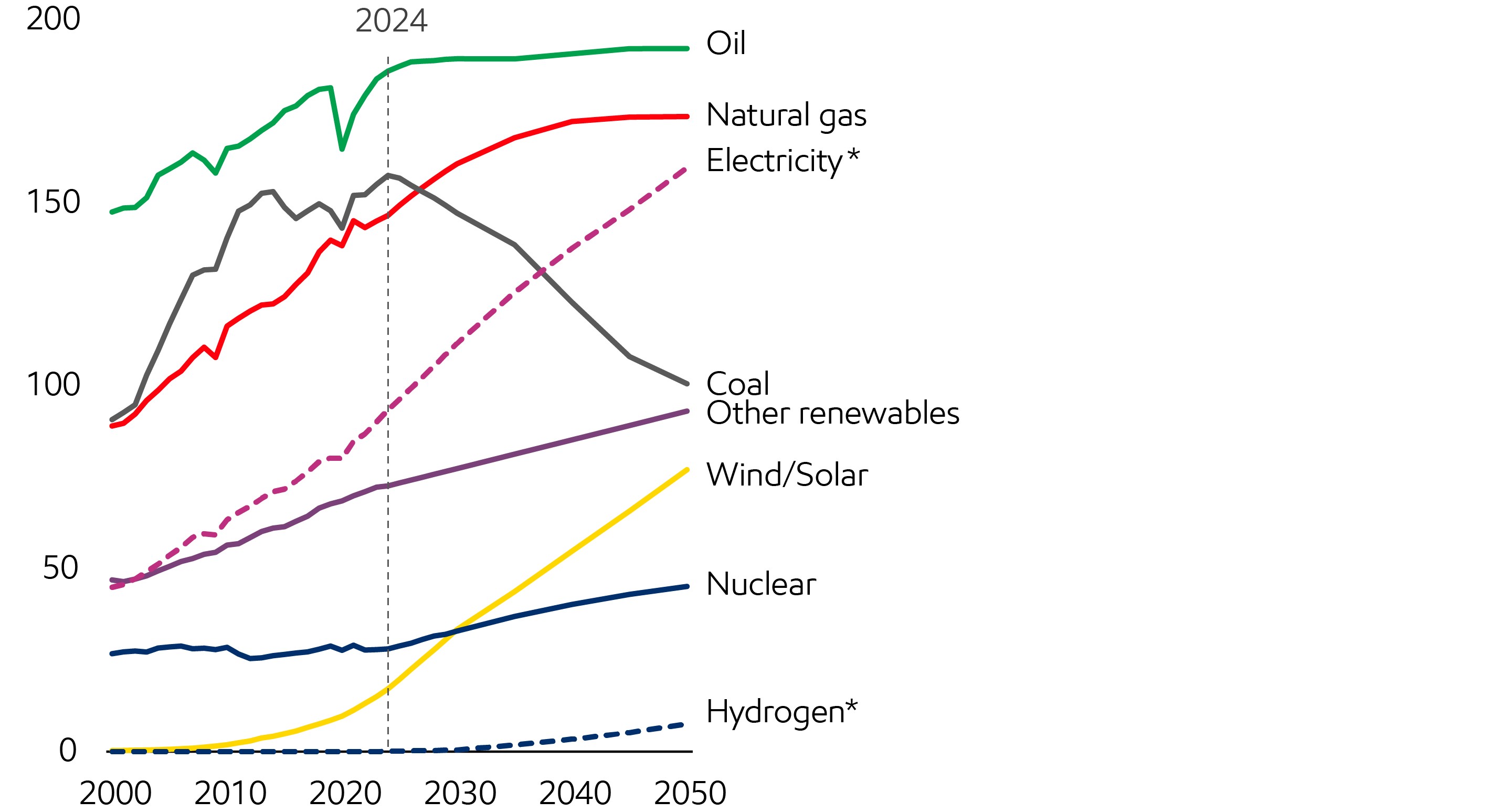

- Oil is projected to remain the largest source of primary energy, as it is essential for industrial manufacturing, including as a raw material, and commercial transportation.

- Natural gas demand is projected to rise, largely to help meet increasing needs for electricity and lower-emission industrial heat.

- Lower-emission energy sources, including solar, wind, and biofuels, are expected to have the fastest rate of increase.

- By 2050, the world is expected to use 35% less coal than it does today as lower-emission sources meet an increasing share of rising demand in the developing world.

4 min read

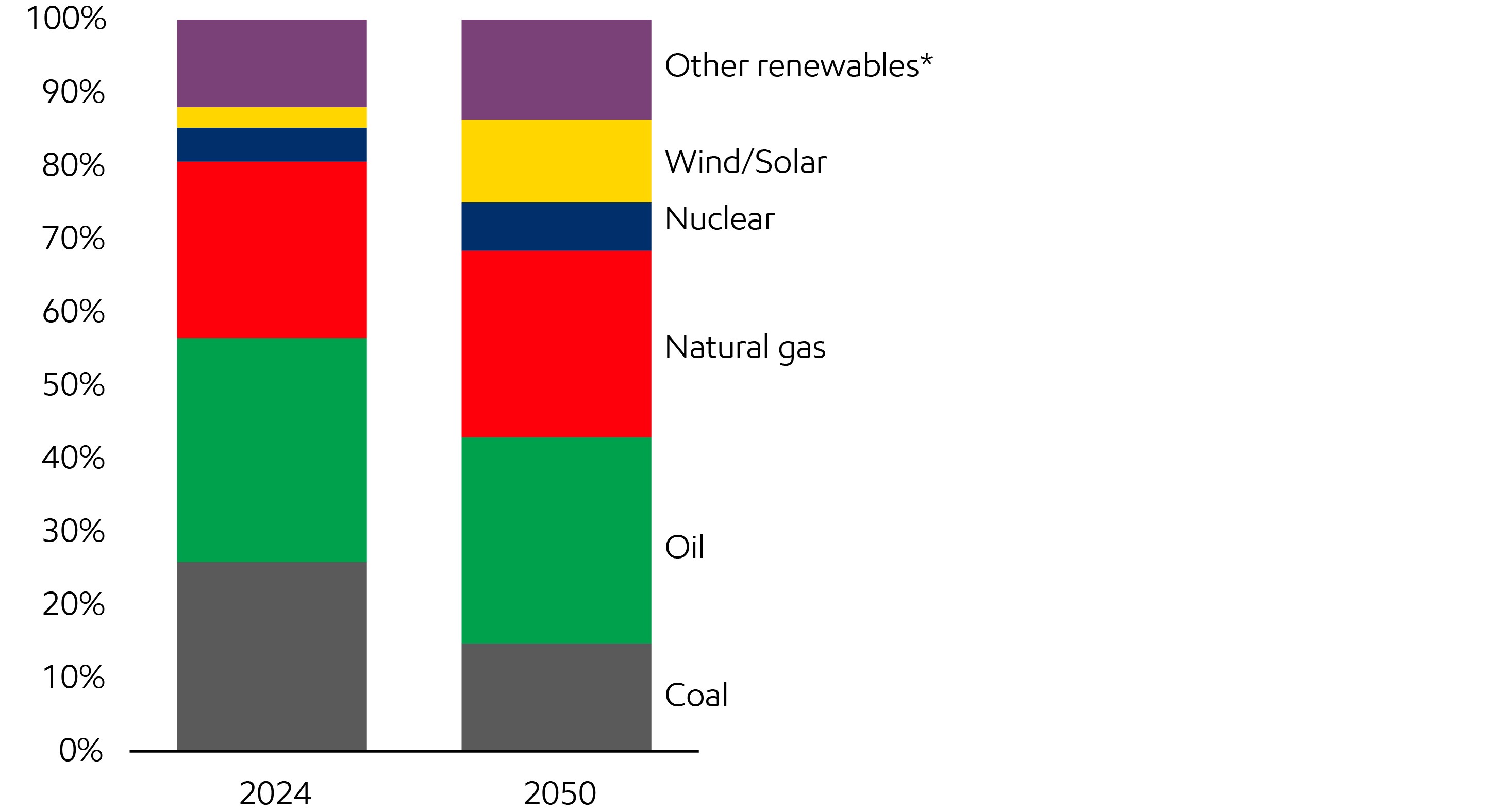

• Aug. 28, 2025The Global Outlook projects that oil and natural gas will be the largest energy sources in 2050, and make up more than half of the world’s energy supply. The biggest change in the world’s energy mix between now and 2050 will be a significant increase in solar and wind, coupled with a large reduction in coal.

Global energy demand by fuel

Primary energy - Quadrillion Btu

Percent of primary energy

*includes biomass, biofuels, hydropower, geothermal

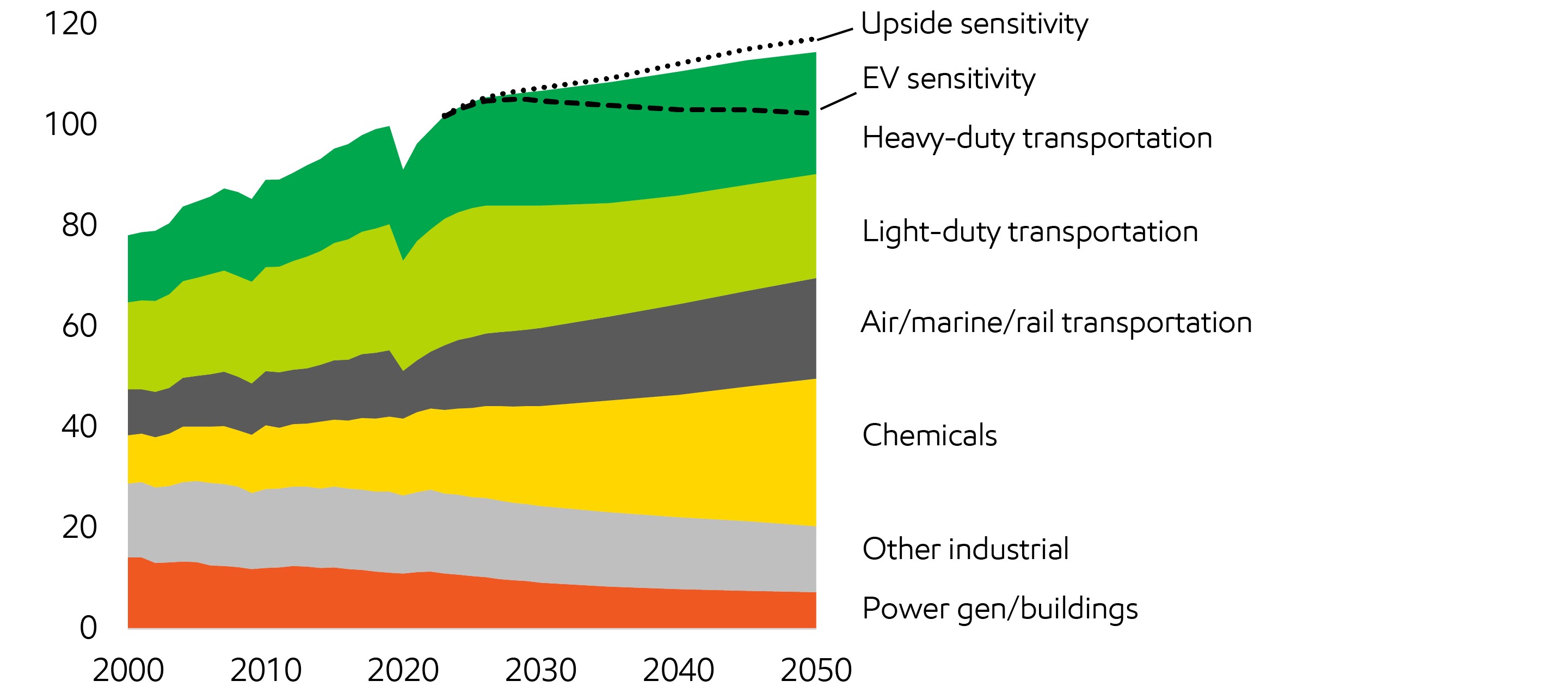

Demand for oil is projected to grow to ~105 MBD by 2050, up from ~100 MBD today, while demand for natural gas is projected to grow to ~500 BCFD in 2050, an increase of 20% compared to current levels. The Outlook’s projection for oil and gas demand is driven by the unique needs of industry and commercial transportation which, combined, make up 75% of global oil demand, >40% of natural gas demand (excluding off-site electricity), and ~50% of electricity demand in 2050.

Global electricity demand is expected to grow 70% by 2050, driven by improving living standards in developing countries. Renewables see significant growth with solar and wind generation projected to increase more than fourfold, from <15% of the world’s electricity generation to >40%. Coal use will shrink as it is displaced by lower-emission energy sources – not just renewables but also natural gas, which has about half the carbon intensity of coal in electricity generation (EIA, Natural Gas Explained).

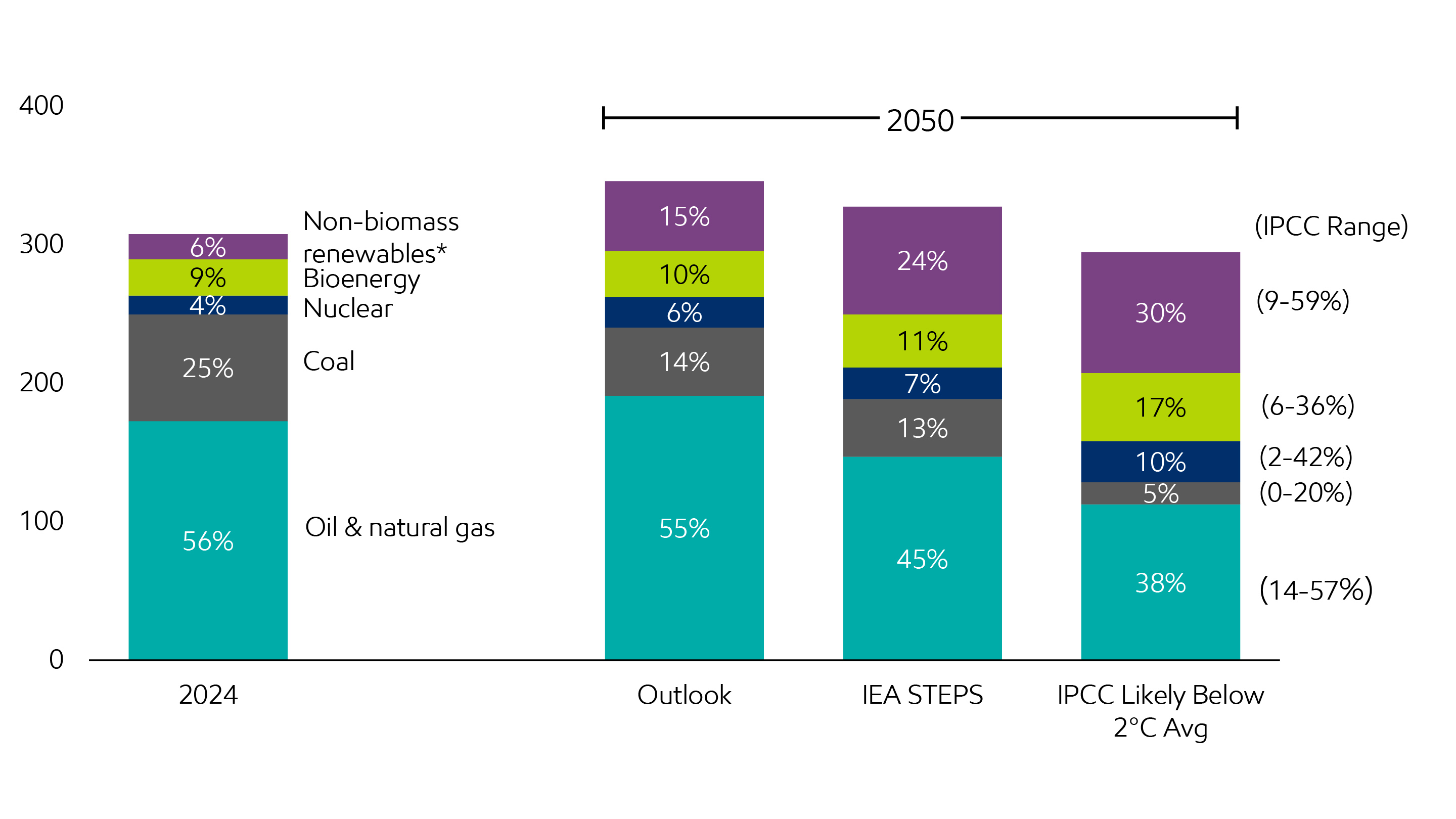

How does ExxonMobil’s Global Outlook compare to other projections or scenarios?

Global energy mix

Million barrels per day of oil equivalent

*Non-biomass renewables includes hydro, wind, solar, and geothermal

Source: 2024 IEA World Energy Outlook; IPCC: AR6 Scenarios Database hosted by IIASA release 1.0 average IPCC C3: “Likely below 2°C” scenarios

The IPCC’s average of Likely Below 2°C scenarios include considerably larger efficiency gains, which lower overall energy demand, and faster deployment of renewables, which grow to ~30% of total global energy. Under these scenarios, oil and natural gas still play the largest role in 2050 at 38% of total global energy supply.

Averages can mask large underlying differences, so it is also important to look at the range of energy-mix outcomes across the IPCC's 311 Likely Below 2°C scenarios. Some include coal being completely eliminated by 2050. Some include a revival of nuclear that brings this emissions-free energy source to 42% of the world’s total energy. Some include renewables growing approximately 10x to become the world’s dominant energy source. And some include oil and natural gas remaining the largest energy source and actually delivering more of the world’s energy supply than they do today, while still hitting the likely below 2°C target.

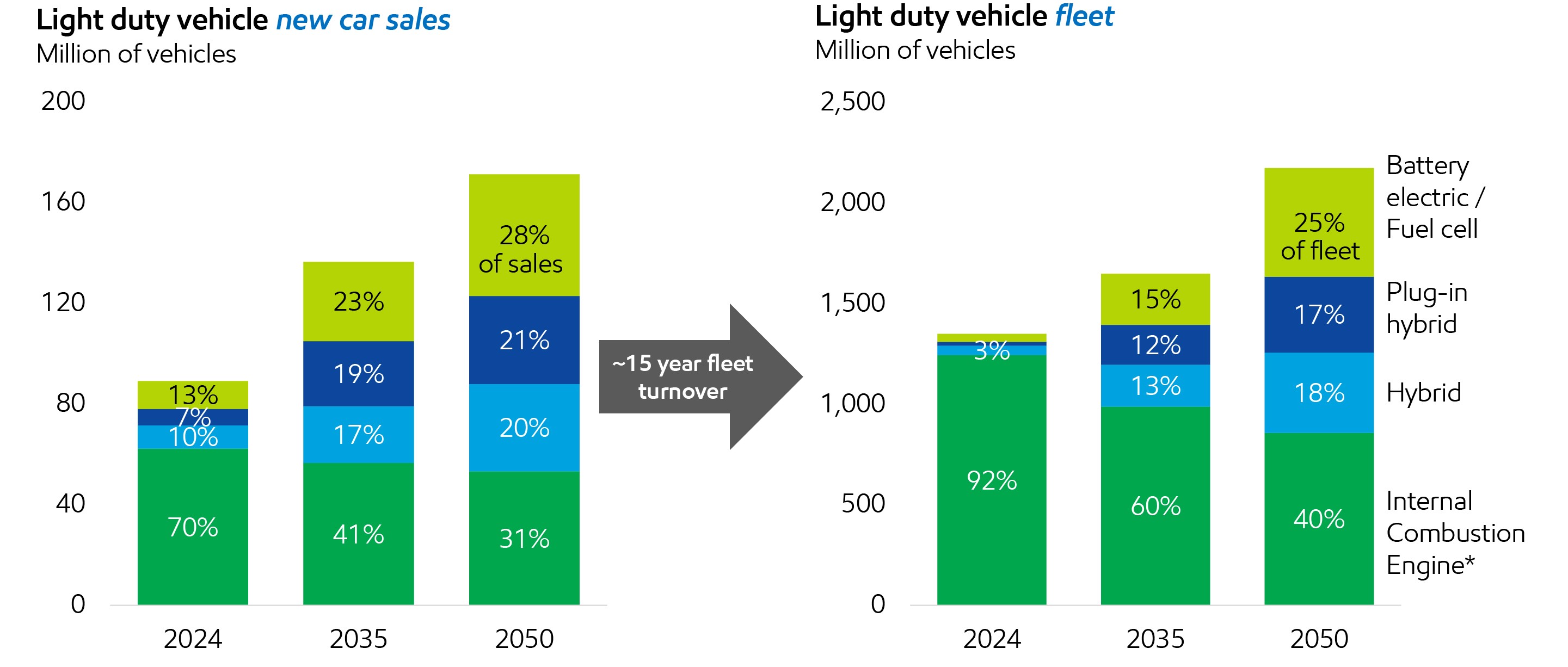

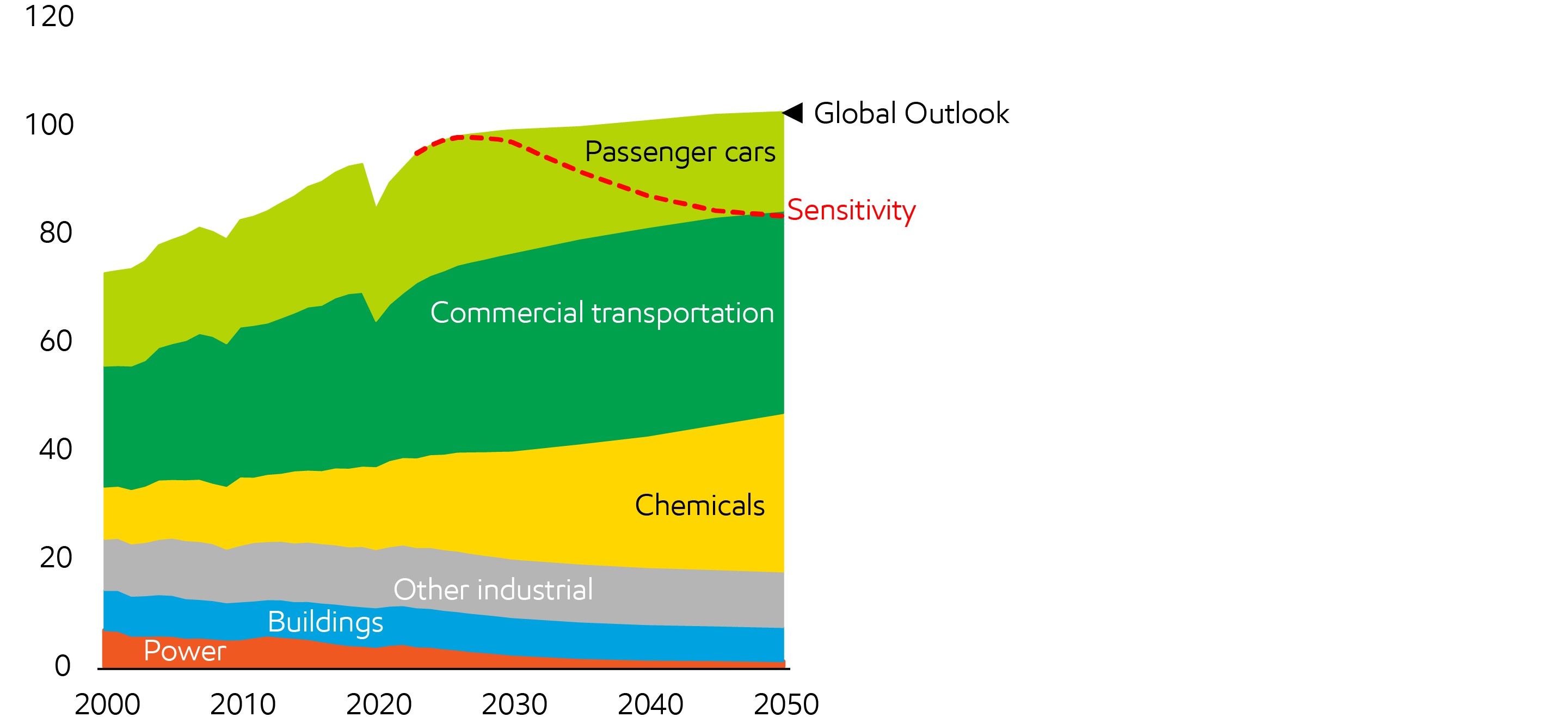

Sensitivity: Road transportation fuel demand

As our look-back showed, there is uncertainty in all projections of future energy demand. Let’s explore how electrification of road transportation could impact projections of oil demand.

Passenger cars

Sales of electric vehicles have grown significantly in recent years, now making up ~20% of total sales. However, the mix of electric vehicles has also shifted, with plug-in hybrids now making up more than a third of electric vehicle sales.

*Includes gasoline, diesel, and CNG/LPG vehicles

Despite rapidly growing sales, the global passenger car fleet is still only <5% electric vehicles (including BEV, PHEV, and fuel cell), as it takes ~15 years for the fleet to turnover. Our Outlook projects that by 2050, electric cars will make up ~50% of global sales, and ~40% of the global passenger car fleet.

Oil excl. biofuels demand back to '10 levels in sensitivity

Million barrels per day

This reflects an ExxonMobil hypothetical sensitivity; not a base case

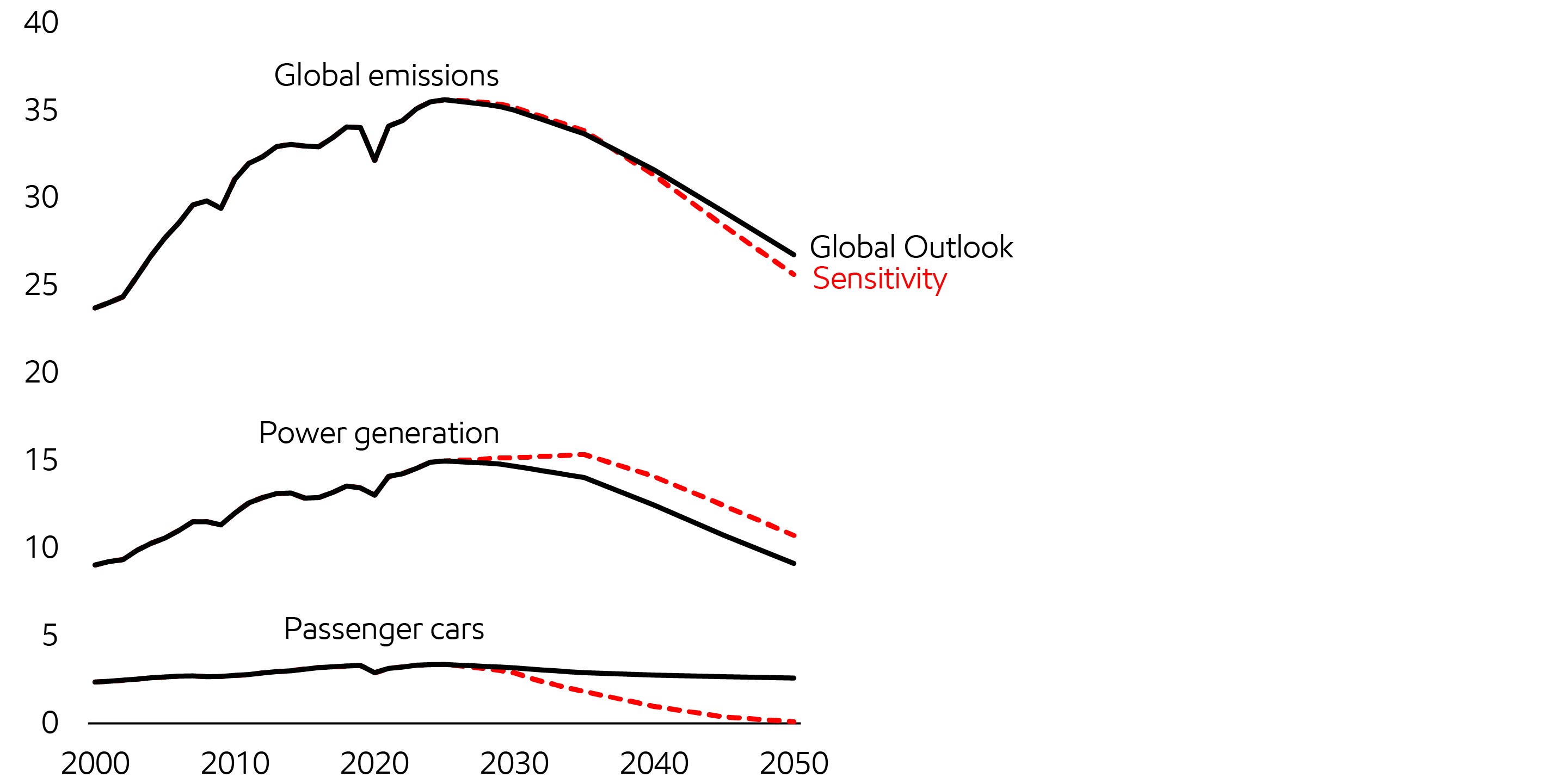

Energy-related CO2 emissions down 5% in sensitivity

Billion tonnes

This reflects an ExxonMobil hypothetical sensitivity; not a base case

Passenger car sensitivity analysis: But what would be the impact on oil demand if EV sales grow faster than our Outlook projects?

The Global Outlook projects battery-electric vehicles to be ~25% of all new car sales by 2035 and ~30% by 2050 (excluding plug-in hybrid electric vehicles and fuel cell). Compare that to this sensitivity, which assumes 100% battery electric vehicle sales from 2035 onward, resulting in an almost fully electrified global car fleet by 2050.

This 100% electric fleet would reduce global demand for oil back to the same levels they were in 2010. Global CO2 emissions decrease ~5% versus the Global Outlook, with the decline in light-duty CO2 emissions partially offset by emissions from increased power generation.

Heavy-duty trucks

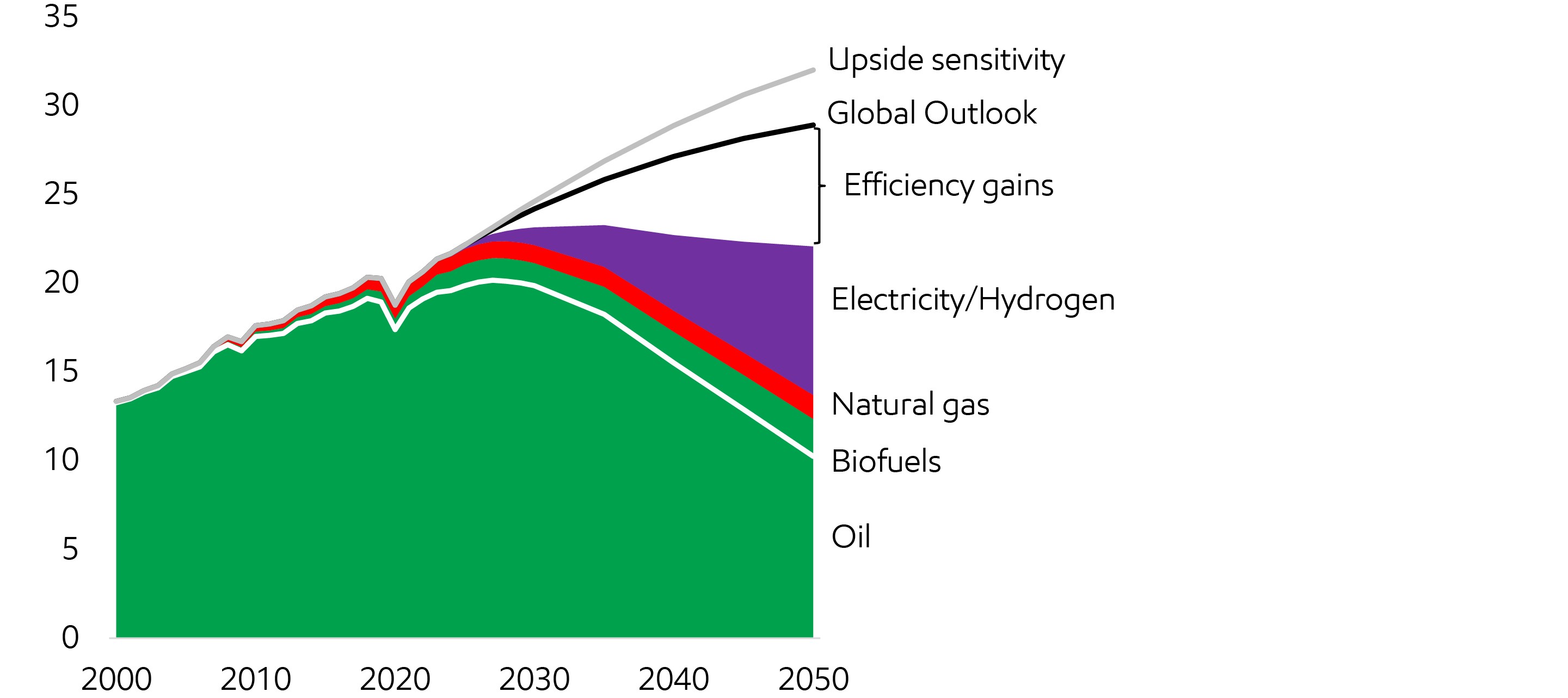

Heavy-duty truck sensitivity analysis: What if technology advances enabled faster transition to lower-emission freight solutions?

This technology sensitivity evaluates sales reaching nearly 100% electrification of light commercial vehicles, about 70% alternative fuels in medium commercial vehicles, and about 20% penetration of alternative fuels in long-haul commercial vehicles by 2050.

This technology sensitivity results in 2050 liquids demand similar to current levels, as the growth in electrification, the use of hydrogen, and efficiency gains offset the growing demand for commercial transportation.

Heavy-duty fuel demand

Million barrels per day of oil equivalent

Alternate EV sales assumption: 100% LCV by 2035, and 70% MCV and 20% HCV by 2040

This reflects an ExxonMobil hypothetical sensitivity, not a base case

Fuel share analysis is based on IEA Transport Project, ExxonMobil analysis

Oil (excl. bio) demand with heavy-duty truck sensitivity

Million barrels per day

Technology development to drive continued efficiency gains is also important. An alternate (upside) sensitivity explores the impact if no further fuel efficiency gains are made (vs. our Outlook which projects continued improvement at historical trends of ~0.5% per year). This sensitivity results in an ~10% increase of heavy-duty fuel demand in 2050.

-

Affordability will drive the pace of any energy transition

Sustained economic growth and continued innovation to reduce costs for key technologies are essential for improving affordability.Learn more -

Sustained oil and gas investment is more important than ever

Oil and natural gas supply from producing wells naturally declines over time, which requires investment in new and existing fields to meet demand across scenarios.Learn more

Global Outlook

Explore more

Cautionary statement

The Global Outlook includes Exxon Mobil Corporation’s internal estimates of both historical levels and projections of challenging topics such as global energy demand, supply, and trends through 2050 based upon internal data and analyses as well as publicly available information from many external sources including the International Energy Agency. Separate from ExxonMobil’s analysis, we discuss a number of third-party scenarios such as the Intergovernmental Panel on Climate Change Likely Below 2°C and the International Energy Agency scenarios. Third-party scenarios discussed in this report reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use and inclusion herein is not an endorsement by ExxonMobil of their results, likelihood or probability. Work on the Outlook and report was conducted during 2024 and 2025. The report contains forward-looking statements, including projections, targets, expectations, estimates and assumptions of future behaviors. Actual future conditions and results (including but not limited to energy demand, energy supply, the growth of energy demand and supply, the impact of new technologies, the relative mix of energy across sources, economic sectors and geographic regions, imports and exports of energy, emissions and plans to reduce emissions) could differ materially due to changes in a number of factors, including: economic conditions, the ability to scale new technologies on a cost-effective basis, unexpected technological developments, the development of new supply sources, changes in law or government policy, political events, demographic changes and migration patterns, trade patterns, the development and enforcement of global, regional or national mandates, changes in consumer preferences, war, civil unrest, and other political or security disturbances, including disruption of land or sea transportation routes; decoupling of economies, realignment of global trade and supply chain networks, and disruptions in military alliances and other factors discussed herein and under the heading “Factors Affecting Future Results” in the Investors section of our website at Exxon Mobil Corporation | ExxonMobil

The Outlook was published in August 2025. ExxonMobil assumes no duty to update these statements or materials as of any future date, and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of this material as of any future date. The Global Outlook is a voluntary disclosure and are not designed to fulfill any U.S., foreign, or third-party required reporting framework. This material is not to be used or reproduced without the express written permission of Exxon Mobil Corporation. All rights reserved.