4 min read

• Aug. 28, 2025Introduction

4 min read

• Aug. 28, 2025For decades, ExxonMobil has published an Outlook that describes where we see global supply and demand for energy and products headed in the future.

We employ a dedicated team of experts in energy and product markets to make projections decades ahead – in the latest version, out to the year 2050.

The Global Outlook serves multiple purposes. First and foremost, it establishes the basis for our long-term business planning. Our industry is capital intensive and long term by nature. We need to understand what the world could look like in coming decades to plan and deploy capital wisely.

Yet the Global Outlook serves a broader purpose as well. Energy and products are inseparable from modern life. Access to affordable and reliable energy drives unprecedented economic progress and improved living standards. They also contribute to global emissions. Our Global Outlook provides important insights on the economic advantages and environmental considerations that play a part in the future of energy.

The projections at the heart of the Global Outlook represent our most likely view of the world in 2050. It is scientifically grounded, based on our detailed analysis of a variety of data sources and long-term assessments of market fundamentals, economic trends, technology advancements, consumer behavior and climate-related public policy. It is not an endorsement of a particular outcome, nor is it advocating for what ExxonMobil hopes will happen.

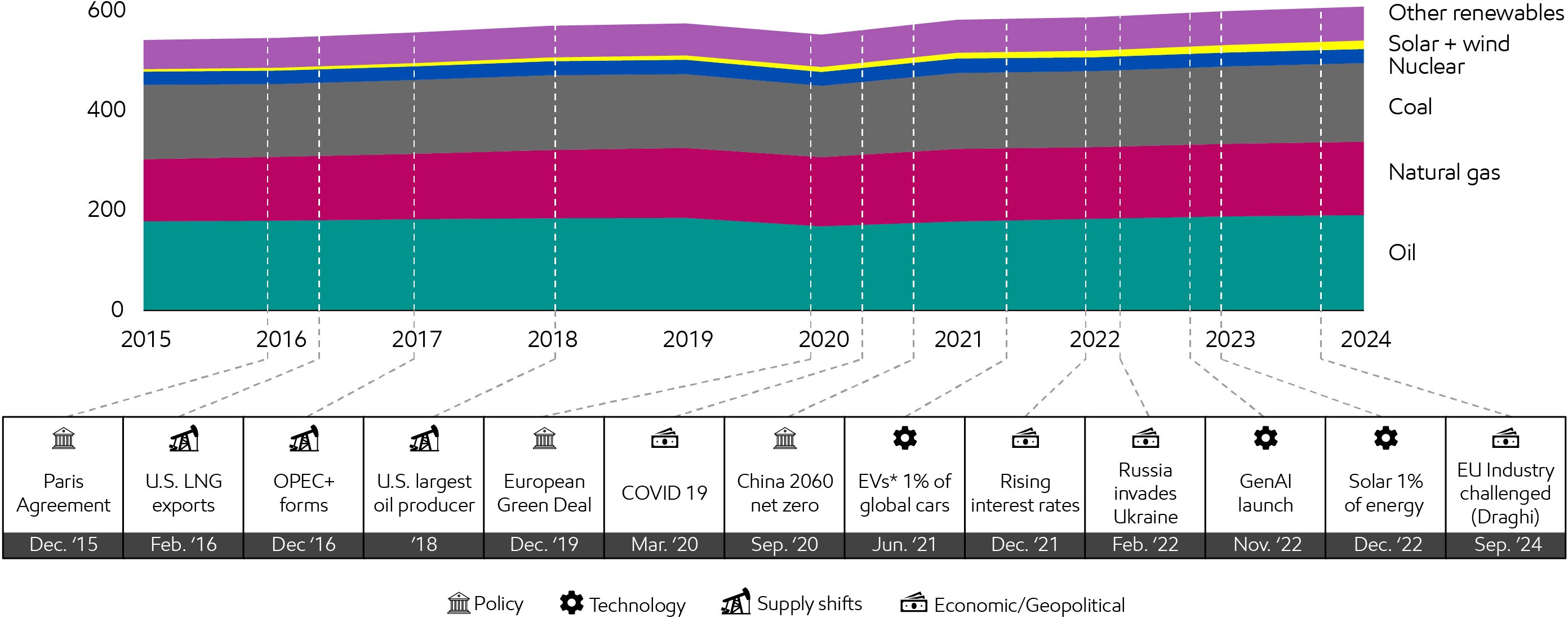

There is uncertainty inherent in any future projection, and it is important to constantly learn and improve our insights and models. Think about it. Over the last 10 years we’ve seen the signing of the Paris Agreement for climate action, a global pandemic, Russia’s invasion of Ukraine significantly alter global gas flows, the reemergence of the U.S. as an oil exporter, and huge growth in deployment of renewable energy. These are just a few examples, and yet through all of this, rising prosperity and energy demand have remained inextricably linked, and the global energy mix has remained largely unchanged.

The global energy mix has remained largely constant in a dynamic world (2015 – 2024)

Quadrillion Btu

Sources: UNFCC, EIA, OPEC, EU Commission, EIA, US Federal Reserve, Grantham Institute

*EVs include Battery Electric and Plug-in hybrids

Looking back at our 2015 Outlook, we can see that while that projection wasn’t perfect, it provided a sound basis for our strategies and plans. This “look-back” also highlights the immense scale and inertia of the energy system. Large economic and geopolitical events had either near-term or localized impacts, but only minor impact relative to the projections made 10 years ago. (Source is ExxonMobil analysis unless otherwise noted. See "About the ExxonMobil Global Outlook" for additional information.)

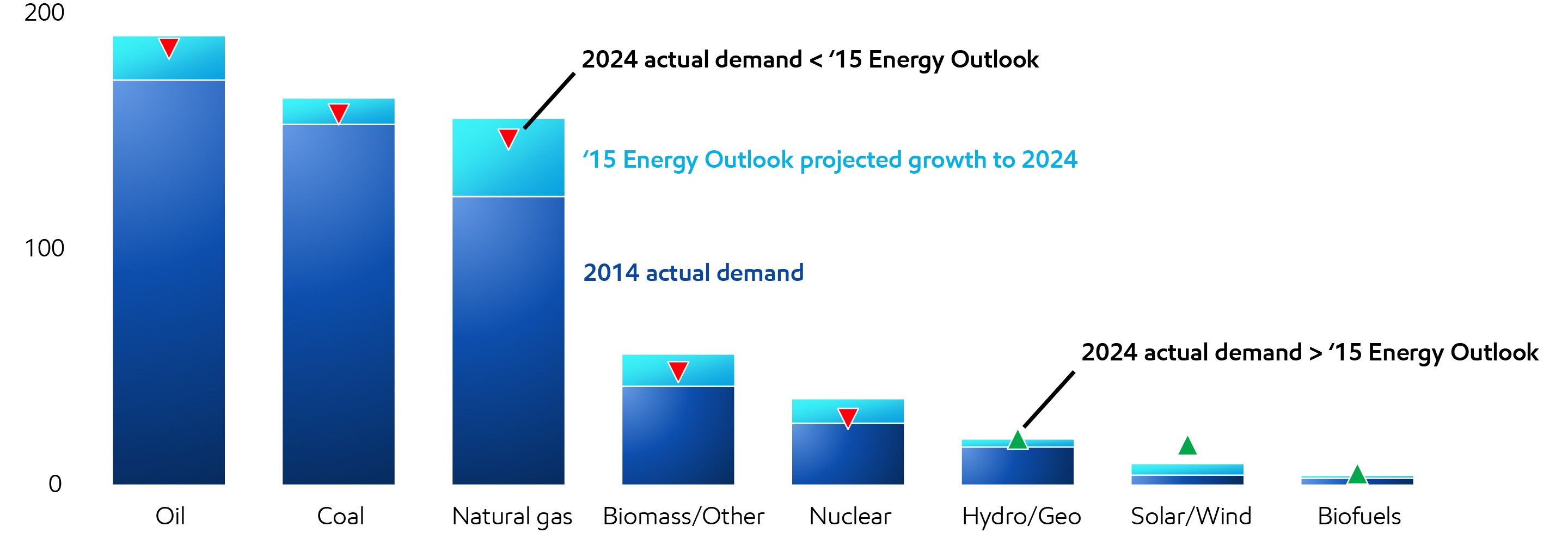

Energy trends over the past decade validate our 2015 Outlook

Quadrillion Btu

’15 Energy Outlook refers to ExxonMobil’s 2015 Energy Outlook

2024 Actual demand is an estimate and may be revised as full country reporting lags 12-18 months

See “About the ExxonMobil Global Outlook” for history data sources

Oil excludes biofuels

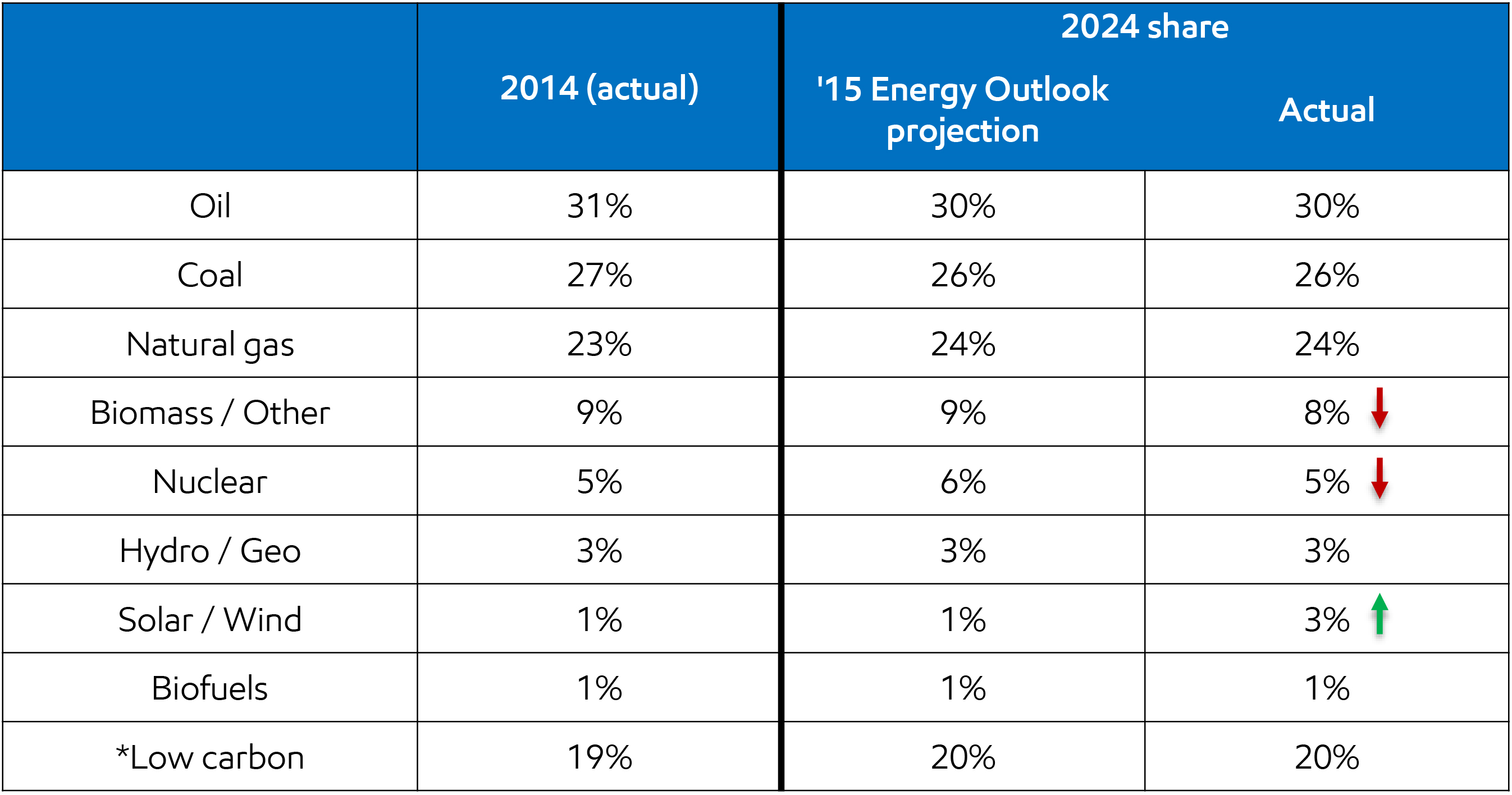

2024 Global energy mix vs. ‘15 Energy Outlook projection

’15 Outlook refers to ExxonMobil’s 2015 Energy Outlook

*Low carbon includes Biomass, Biofuels, Nuclear, Hydro, Geothermal, Solar, and Wind

Oil excludes biofuels

Digging deeper into this look-back analysis, there are several insights that inform our current Outlook and highlight some of the challenges society faces as it works to lower emissions while providing affordable, reliable energy that underpins economic growth. For example, in 2024, global energy demand was ~4% lower than we projected in our 2015 Outlook. Some of this difference is related to the pause in growth during the pandemic, but a bigger driver was slower economic development in Latin America and Sub-Saharan Africa. The 2015 Outlook had assumed rising prosperity in these regions, but income per capita was stagnant over the past ten years. These trends reinforce that rising prosperity and energy demand are inextricably linked.

Oil demand (excluding biofuels) was 2% lower than projected, with the shortfall again due to slower economic development in emerging economies. Oil demand in high income OECD countries and China grew stronger than we had projected a decade ago, led by higher demand for transportation fuels.

Natural gas demand grew the most over the last decade, but 2024 demand was 6% lower than our 2015 Outlook projection. The developing world, excluding China, contributed, as did Europe where the loss of pipeline gas and higher prices following Russia’s invasion drove Europe’s gas demand nearly 20% below our 2015 Outlook projection. Low-cost domestic gas resources in the United States and Middle East drove stronger demand growth than the 2015 Outlook projection.

We also see solar and wind grew nearly twice as much as we had projected in our 2015 Outlook, with over half of the difference occurring in China. The combination of policy incentives and technology cost declines encouraged faster deployment. But even with the faster growth, solar and wind still only made up ~3% of the world’s energy mix in 2024. This illustrates the massive scale of the global energy system.

Looking more broadly at all low carbon sources, including nuclear and other renewables, we see low carbon sources gained 1% share over the past decade, aligned with the 2015 Outlook projection. The faster solar and wind growth was offset by a significant decline in nuclear energy, led by reactor shutdowns in Europe.

Given the uncertainty inherent in any projection, we consider a range of sensitivities and scenarios – including those we view as remote – to help inform strategic thinking. No future projection could exactly predict every new government policy, its effectiveness, or its unintended consequences. Similarly, the pace of technology advancements and extent of public support for more expensive, lower-emission solutions can influence how quickly or cost-effectively different energy pathways might develop.

We make the Global Outlook publicly available because we feel it makes an important contribution to a variety of policy discussions – about energy, about economic development, and about the environment. By offering a clear-eyed, thoughtful view, the Outlook can enhance those discussions and – hopefully – lead to better policy outcomes.

-

Developing countries projected to use 25% more energy as living standards improve

Learn more -

Industry and commercial transportation drive economic growth

Learn more -

CO2 emissions projected to fall 25% by 2050, but more progress is needed

Learn more -

Affordability will drive the pace of any energy transition

Learn more -

All energy types will be needed

Learn more -

Sustained oil and gas investment is more important than ever

Learn more

Global Outlook

Explore more

Cautionary statement

The Global Outlook includes Exxon Mobil Corporation’s internal estimates of both historical levels and projections of challenging topics such as global energy demand, supply, and trends through 2050 based upon internal data and analyses as well as publicly available information from many external sources including the International Energy Agency. Separate from ExxonMobil’s analysis, we discuss a number of third-party scenarios such as the Intergovernmental Panel on Climate Change Likely Below 2°C and the International Energy Agency scenarios. Third-party scenarios discussed in this report reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use and inclusion herein is not an endorsement by ExxonMobil of their results, likelihood or probability. Work on the Outlook and report was conducted during 2024 and 2025. The report contains forward-looking statements, including projections, targets, expectations, estimates and assumptions of future behaviors. Actual future conditions and results (including but not limited to energy demand, energy supply, the growth of energy demand and supply, the impact of new technologies, the relative mix of energy across sources, economic sectors and geographic regions, imports and exports of energy, emissions and plans to reduce emissions) could differ materially due to changes in a number of factors, including: economic conditions, the ability to scale new technologies on a cost-effective basis, unexpected technological developments, the development of new supply sources, changes in law or government policy, political events, demographic changes and migration patterns, trade patterns, the development and enforcement of global, regional or national mandates, changes in consumer preferences, war, civil unrest, and other political or security disturbances, including disruption of land or sea transportation routes; decoupling of economies, realignment of global trade and supply chain networks, and disruptions in military alliances and other factors discussed herein and under the heading “Factors Affecting Future Results” in the Investors section of our website at Exxon Mobil Corporation | ExxonMobil

The Outlook was published in August 2025. ExxonMobil assumes no duty to update these statements or materials as of any future date, and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of this material as of any future date. The Global Outlook is a voluntary disclosure and are not designed to fulfill any U.S., foreign, or third-party required reporting framework. This material is not to be used or reproduced without the express written permission of Exxon Mobil Corporation. All rights reserved.