5 min read

• Aug. 28, 2025CO₂ emissions fall 25% by 2050, but more progress is needed

- Efficiency improvements and renewables are necessary but not a complete solution.

- Technologies like hydrogen, carbon capture and storage, and biofuels have yet to reach their full potential but are needed to reduce emissions on a global scale.

- With the right policies and technology advancements, these solutions can help society move closer to achieving its climate goals.

- There are multiple potential emissions pathways to achieve society’s climate goals, giving policy makers an opportunity to balance affordability and emissions reduction.

5 min read

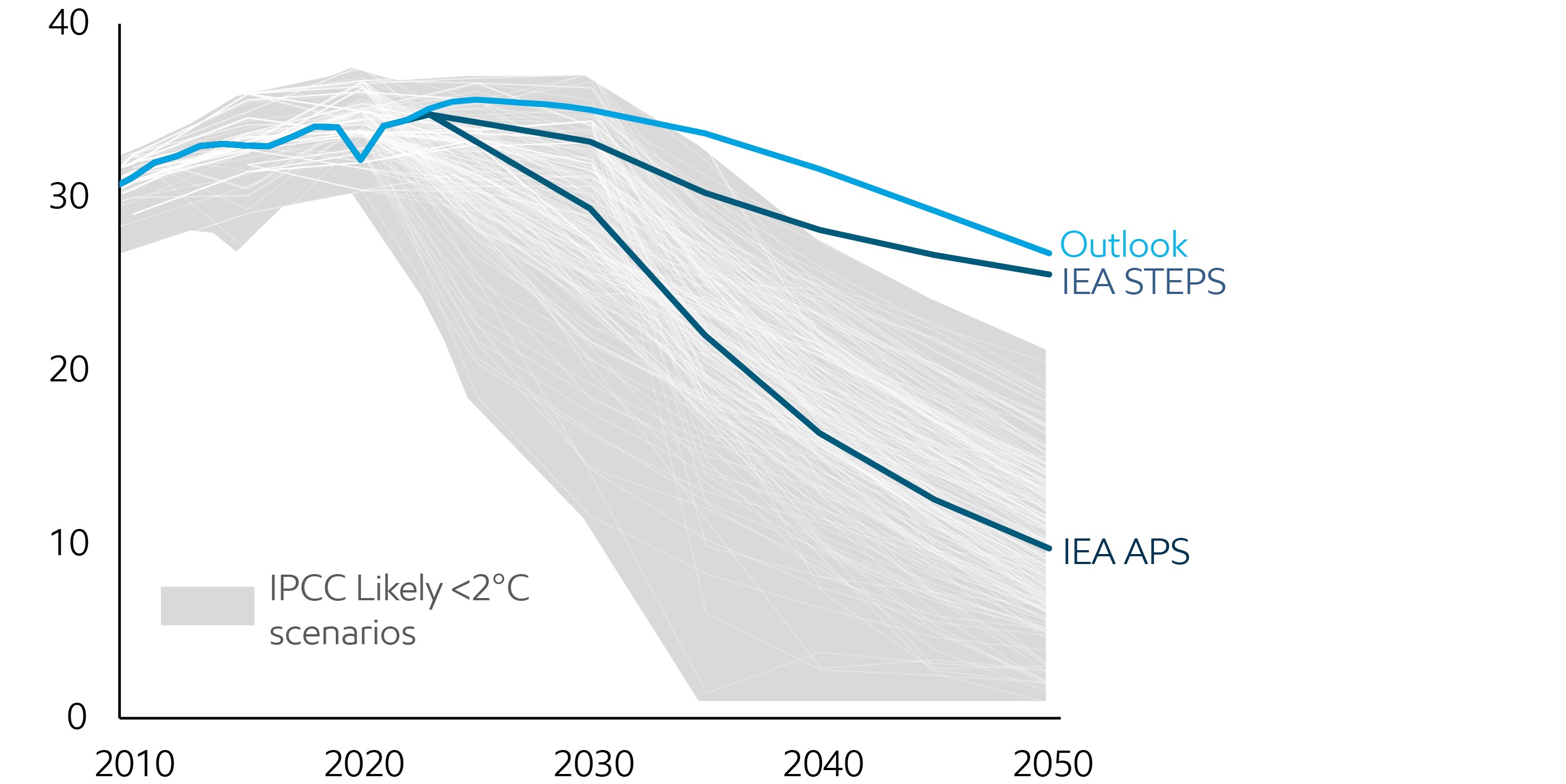

• Aug. 28, 2025For the first time in modern history, emissions are projected to peak and begin a sustained decline this decade as economies expand and living standards improve. By 2050, we project global CO2 emissions to decline by 25% from current levels. This happens because efficiency will improve, and the world will use more lower-emissions technologies, including renewables, carbon capture and storage, hydrogen, and biofuels.

Global energy-related emissions

CO2 Billion metric tons

Source: 2024 IEA World Energy Outlook; IPCC: AR6 Scenarios Database hosted by IIASA release 1.0 average IPCC C3: “Likely below 2°C” scenarios

Emissions do not contain industry process emissions or land use and natural sinks

Overall, energy-related CO2 emissions are projected to peak at approximately 36 billion metric tons per year sometime this decade and then decline to 27 billion metric tons per year in 2050.

That will be great progress. Even so, more is needed to reach emission levels consistent with keeping global temperature increases below 2°C. The average of the IPCC’s Likely Below 2°C scenarios requires energy-related CO2 emissions to fall to around 11 billion metric tons per year by 2050.

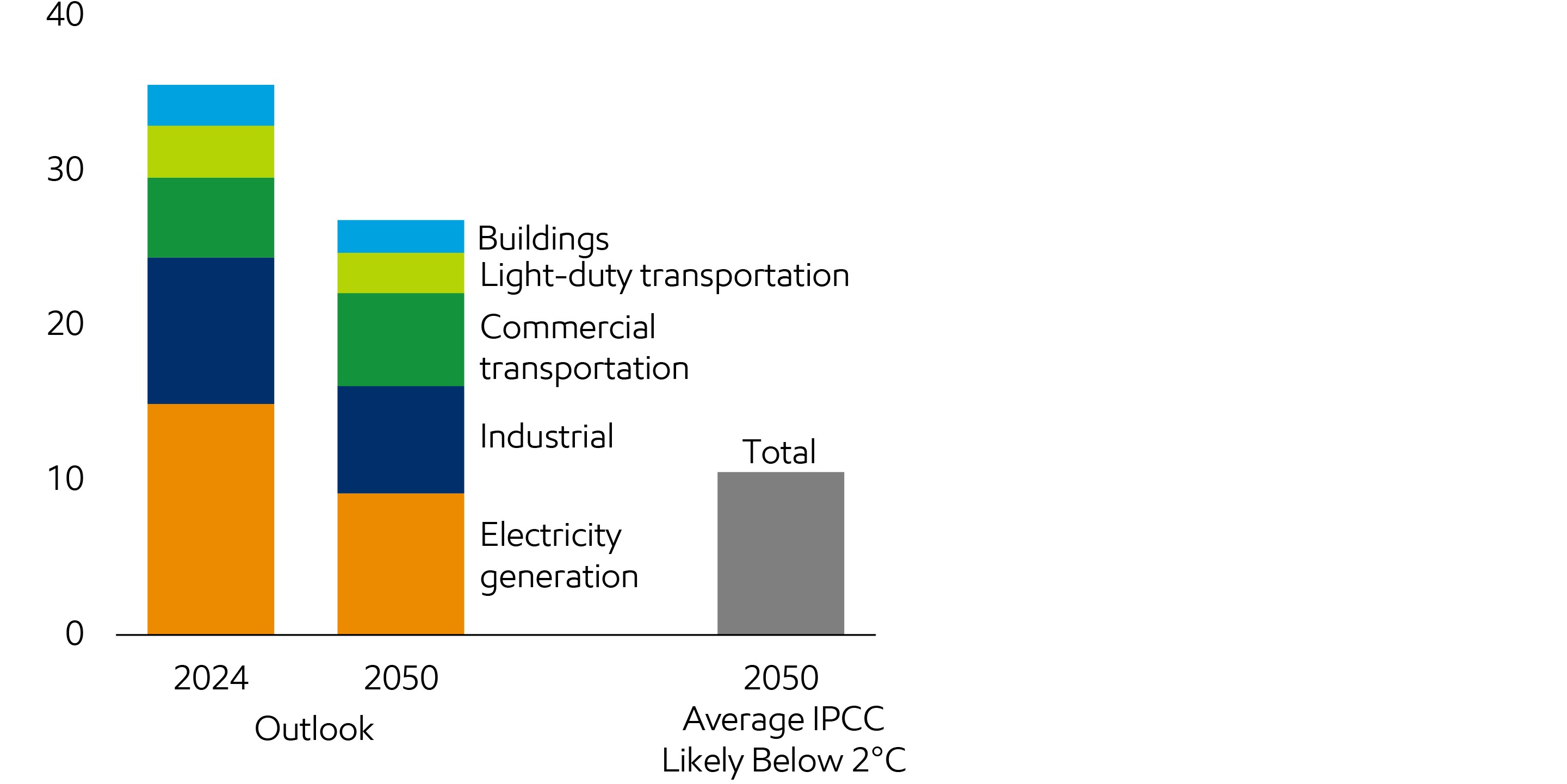

Energy-related emissions

CO2 Billion metric tons

Source: IPCC: AR6 Scenarios Database hosted by IIASA release 1.0 average IPCC C3: “Likely below 2°C” scenarios; ExxonMobil analysis

Emissions do not contain industry process emissions or land use and natural sinks

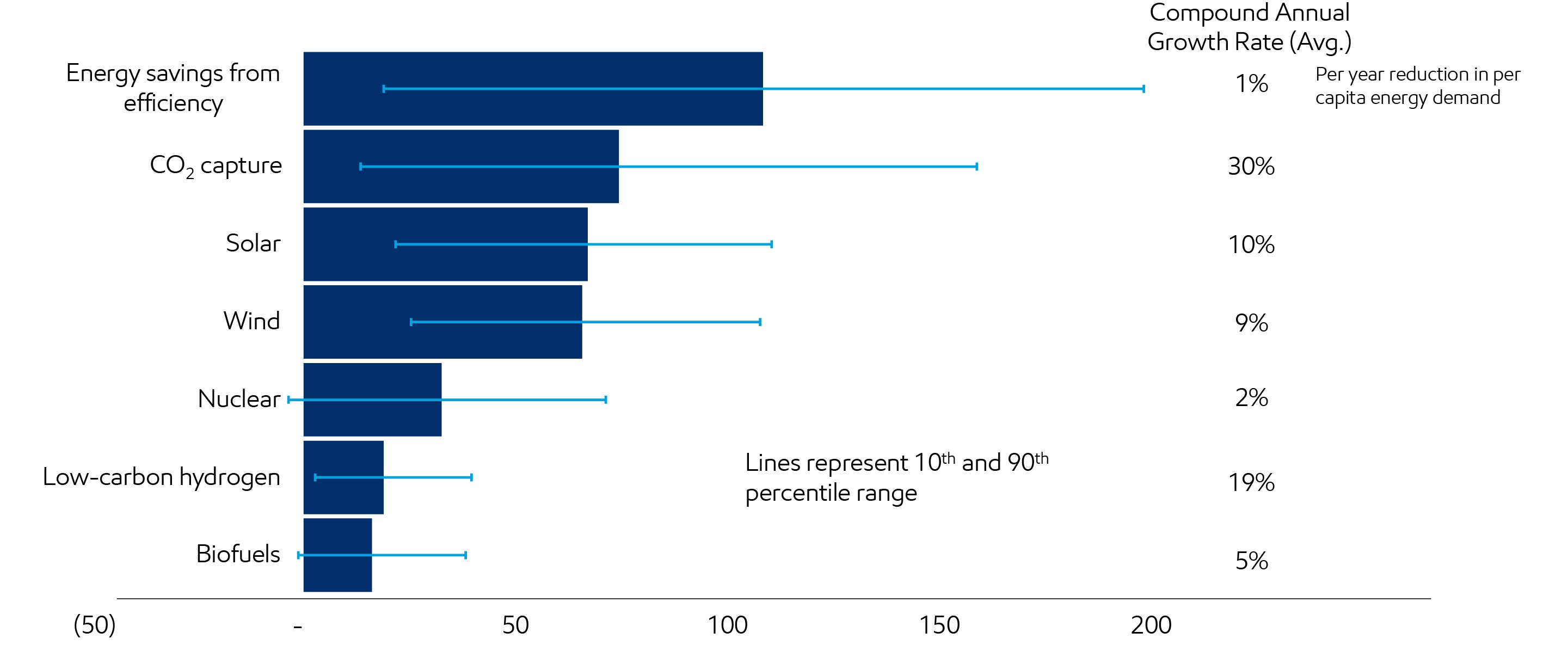

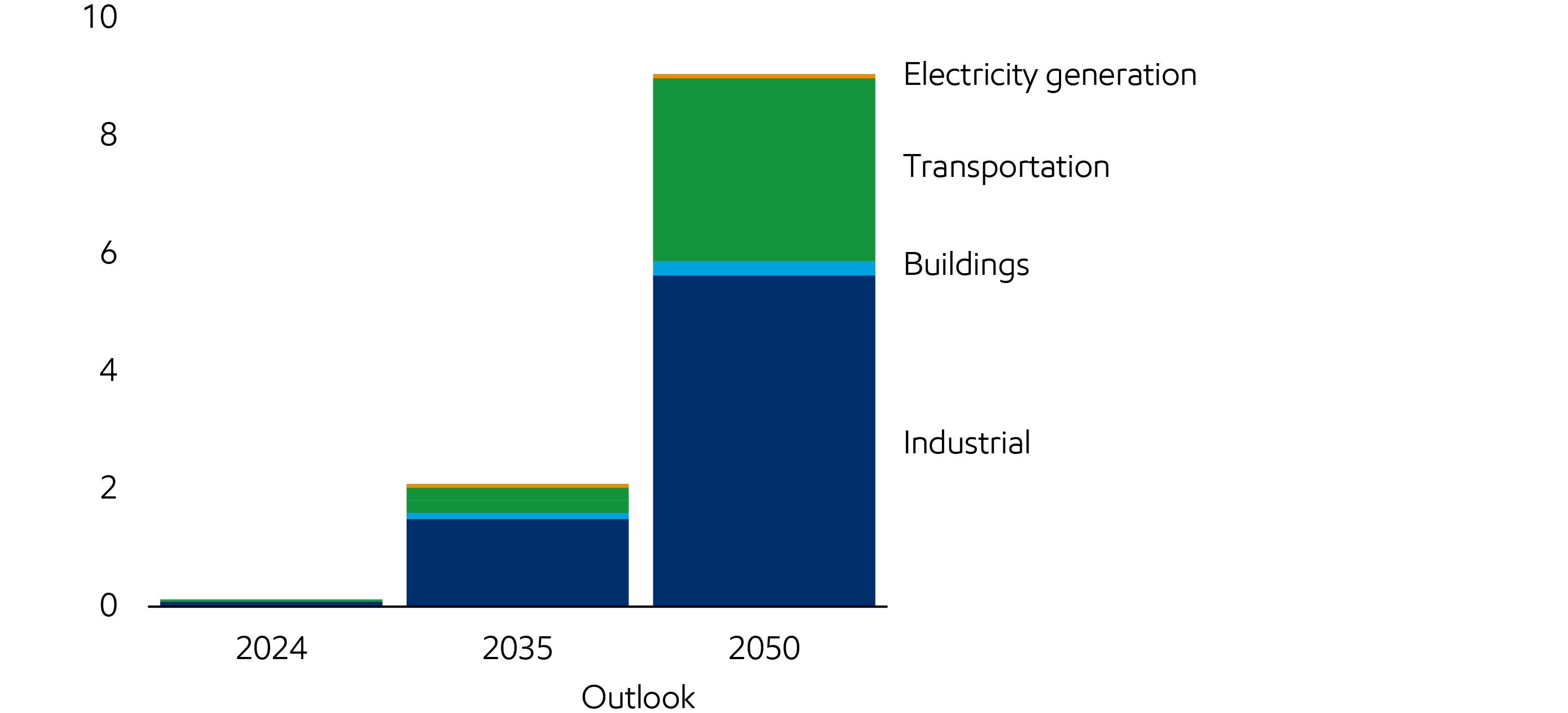

The IPCC and our Outlook see the need for both established and emerging technologies to progress faster, in some cases at an unprecedented buildout.

Solutions deployed in IPCC pathways

Quadrillion Btu growth 2020 to 2050

Source: IPCC: AR6 Scenarios Database hosted by IIASA release 1.0 average IPCC C3: “Likely below 2°C” scenarios; ExxonMobil analysis; Growth from 2020-2050 across the average IPCC Likely below 2° C scenarios; uncertainty bars represent 10th percentile and 90th percentile scenarios

For example, the IPCC’s Likely Below 2°C scenarios suggest that wind and solar needs to grow at an average of 10% per year from 2020 – 2050, which is broadly in line with recent history. However, carbon capture and storage need to grow at more than 30% per year through 2050 to meet the IPCC’s Likely Below 2°C scenarios. CCS is not the only technology that will need to be accelerated on an immense scale. Low-carbon hydrogen and biofuels will need to play a much larger role as well.

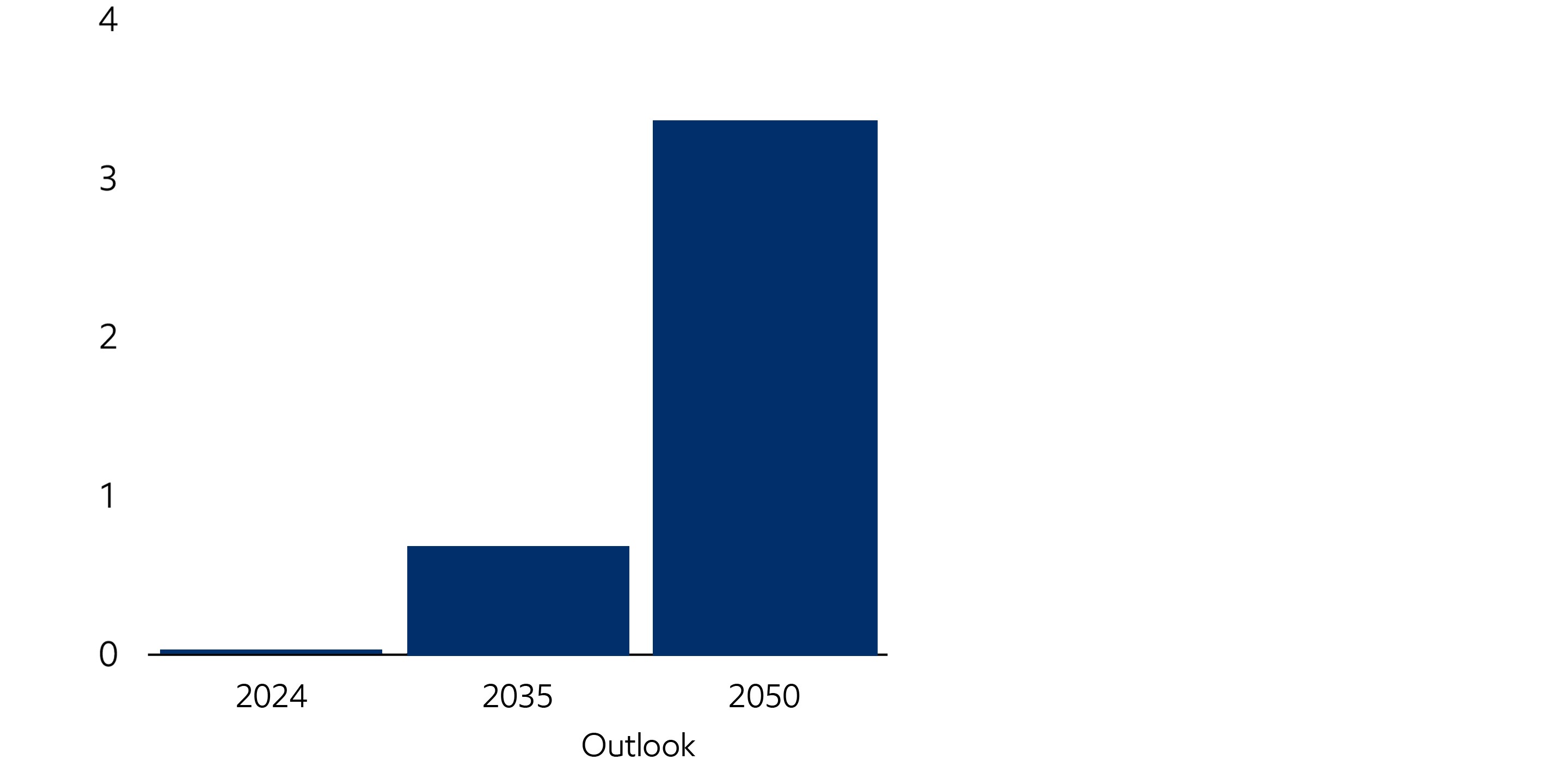

Carbon capture and storage

CO2 Billion metric tons per year

Low-carbon hydrogen-based fuel use

Quadrillion Btu

Biofuels use

Million barrels per day of oil equivalent

Our Outlook projects that CCS, H2, and biofuels will increase ~130x, 80x, and 3x respectively by 2050 vs current levels; however, this is still below the level required in the IPCC Likely Below 2°C scenarios due primarily to a lack of policy support.

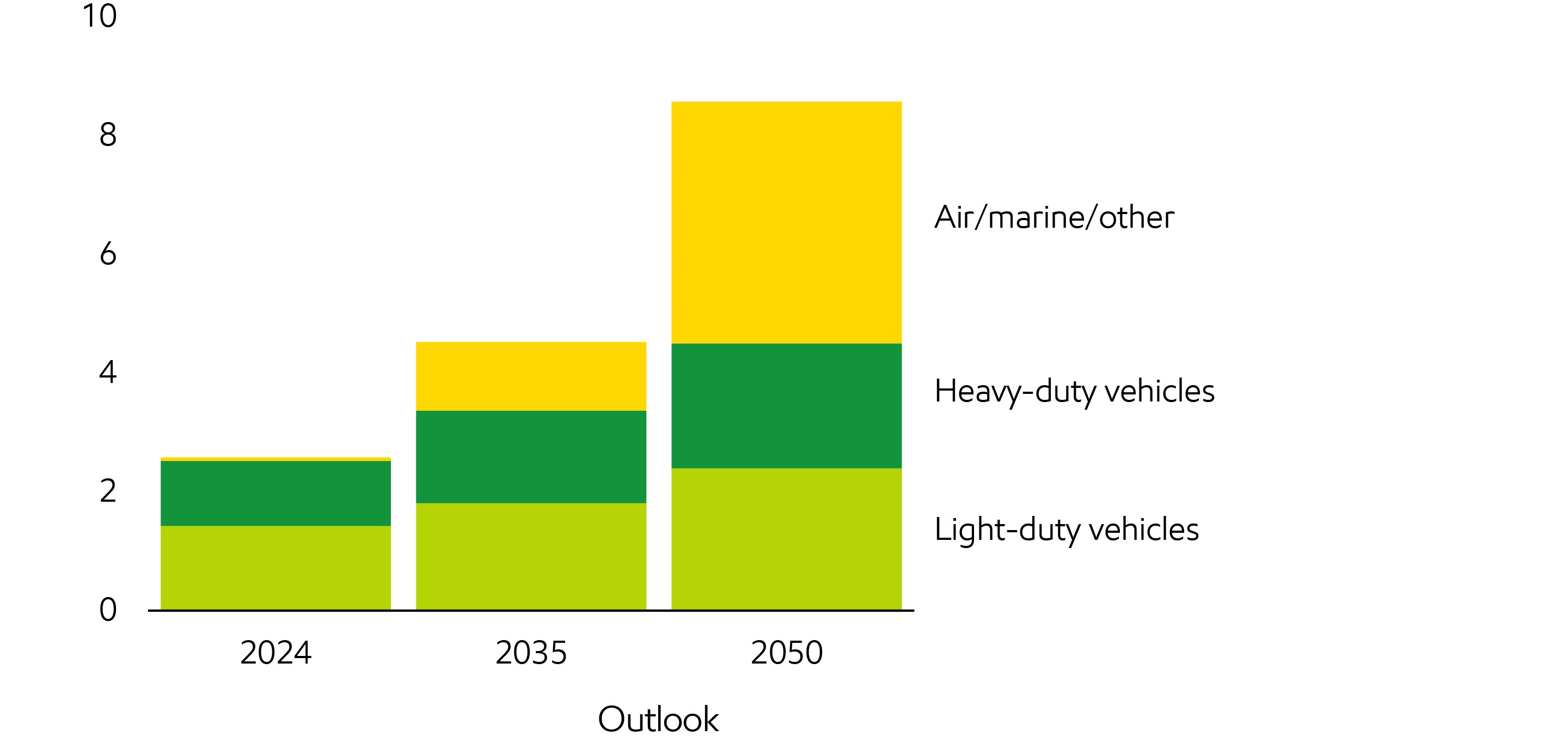

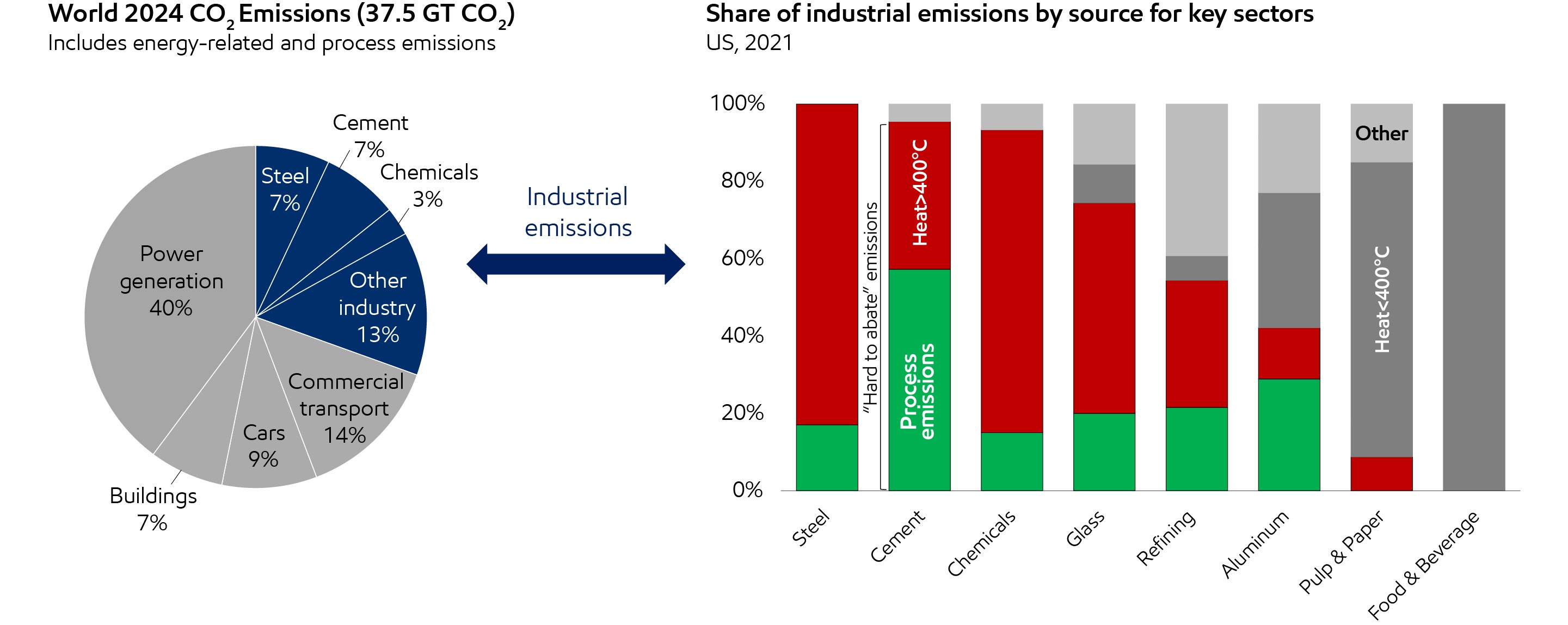

Why are CCS, hydrogen, and biofuels essential for reducing emissions?

We know that energy use will increase by 2050 to support a much larger population and economic growth. We also know that fossil fuels remain the most effective way to produce the enormous amounts of energy needed to support commercial transportation, manufacturing and industrial production, due to their high energy density and ease of transport. That’s why a critical goal of any energy transition will be to reduce emissions from these important “hard-to-decarbonize” sectors, which account for ~45% of all CO2 emissions today (including process emissions, excluding indirect emissions from electricity use).

Source: US Department of Energy Liftoff Reports, 2023; ExxonMobil Analysis

Excludes off-site power generation

When we say these sectors are “hard-to-decarbonize,” what we also mean is that they are “hard-to-electrify.” As even the IEA acknowledges, “Generating high-temperature heat from electricity, especially on a large scale and for electrically non-conductive applications, is impractical and costly with today’s technologies.” (IEA, 2020)

Looking across key industrial sectors, we can see the significant share of emissions from generating heat >400°C where electricity often isn’t currently a viable alternative, and from process emissions where chemical transformations of raw materials releases CO2.

These sectors will require multiple lower-carbon technologies to meet different needs.

- Carbon capture and storage is the process of capturing CO2 emissions at the source and injecting it into deep underground geologic formations for safe, secure and permanent storage. CCS on its own, or in combination with hydrogen production, is among the few proven technologies that can significantly reduce CO2 emissions from high-emitting sectors, including process emissions.

- Low-carbon hydrogen can replace traditional furnace fuel to decarbonize the industrial sector. Hydrogen and hydrogen-based fuels such as ammonia will be important for decarbonizing commercial transportation as technology improves to lower its cost, and policy develops to incentivize the needed infrastructure development.

- Biofuels are expected to play an important role in decarbonizing the transportation space. Biofuels will be critical in helping to reduce emissions in aviation in particular, which cannot rely on electric batteries for commercial air travel.

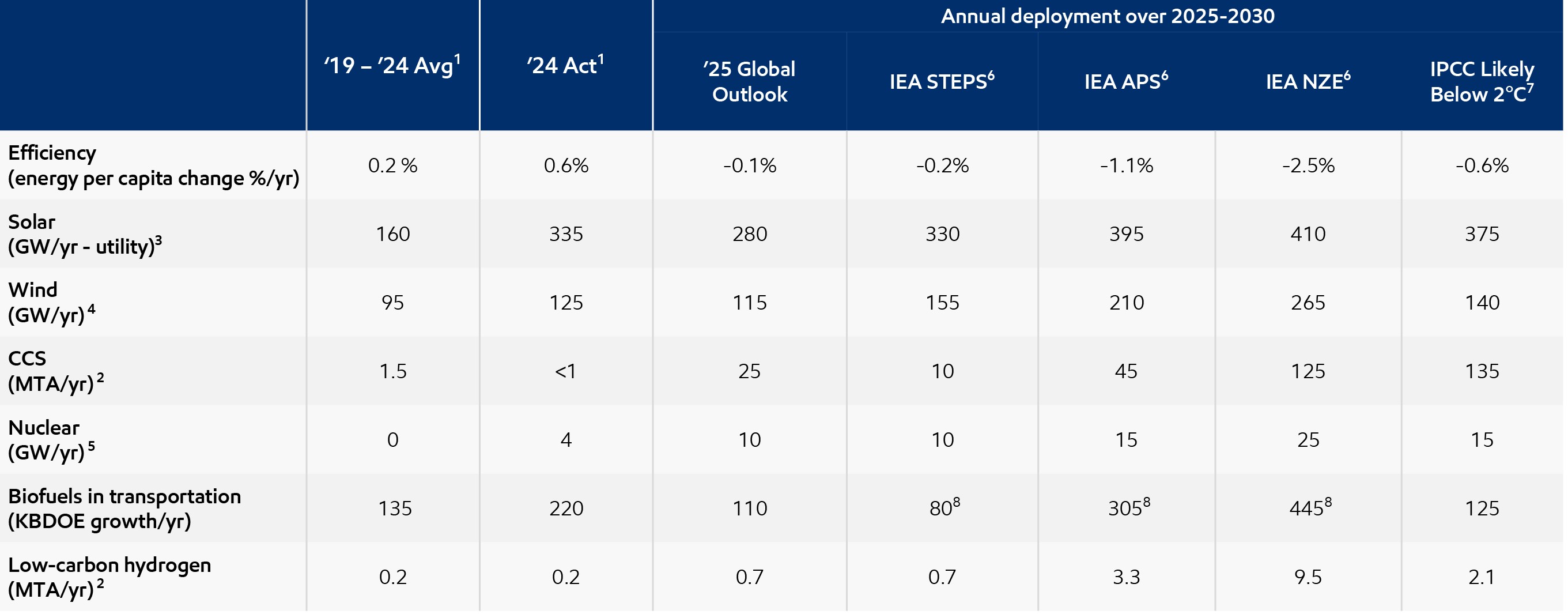

Energy transition signposts

Our Signpost process helps us track the rate of deployment of key technologies.

These signposts provide valuable insight into current trends and what is needed to achieve a range of potential emissions pathways.

- Solar and wind have seen significant acceleration in deployment over recent years, with the largest growth occurring in China.

- Biofuels are also seeing substantial growth driven by both policy and market factors.

- CCS and low-carbon hydrogen are essential technologies in all projections and scenarios, however, have not yet seen material deployment due to lack of policy support.

- Per capita energy demand has continued to rise, driven by developing countries. This trend is projected to reverse this decade as more efficient solar, wind, and natural gas replace coal in power generation.

It is also clear that while there is a range of potential outcomes for each solution to 2030, all solutions need to increase deployment this decade. This is the case for our Global Outlook, IEA STEPS, IEA APS, IEA NZE, and the IPCC Likely Below 2°C scenarios.

What is needed to accelerate emissions reduction?

It has now been 20 years since the Kyoto protocol came into force, and 10 years since the Paris climate agreement. Yet, global energy related CO2 emissions continued to rise at ~1% per year in 2024, which is unchanged vs the 20-year average. This suggests a different policy approach may be needed to reach society’s climate goals.

The IPCC scenarios highlight the importance of considering full climate impact when setting emissions targets, not just focusing on net zero timing. In fact, overly focusing on net zero timing has the potential to constrain energy supply, leading to price shocks which can cause consumers to lose confidence in the economy.

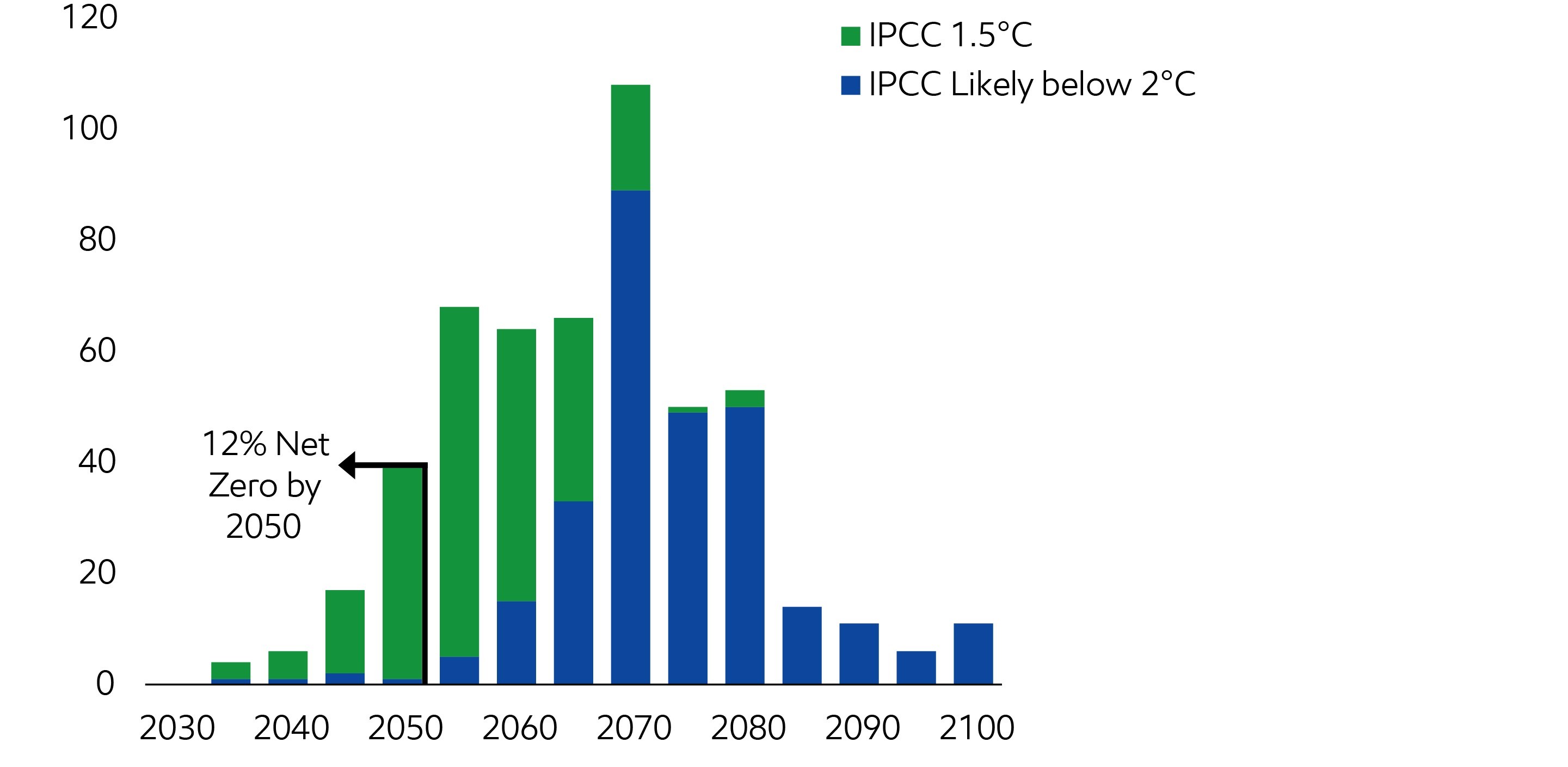

IPCC AR6 projected timing to net zero

# of scenarios at net zero CO2 emissions per 5 year interval

Further, there is no single emissions pathway that defines society’s climate goals. Looking at the IPCC Likely below 2°C scenarios (C3), we see the timing of net zero emissions ranges from ~2050 to >2100. Similarly for 1.5°C scenarios (C1/C2), we see the net zero timing ranges from ~2035 to 2080.

So, what is needed to affordably achieve society’s climate goals?

- Policy should be designed in such a way to avoid sudden energy price spikes that will reduce consumer confidence AND support long-term economic growth which is essential to improving long-term affordability.

- Technology advancements & deployment, supported by “all of the above” technology neutral policy frameworks, will over time reduce technology cost, further improving affordability.

- Market-driven solutions must ultimately develop to naturally select the most cost-effective technologies for companies and consumers.

Want more information? Explore our Advancing Climate Solutions

-

Industry and commercial transportation drive economic growth

These sectors, which make up ~65% of global energy use, have unique needs that cannot be fully replaced with electricity or renewables.Learn more -

Affordability will drive the pace of any energy transition

Sustained economic growth and continued innovation to reduce costs for key technologies are essential for improving affordability.Learn more

Global Outlook

Explore more

Cautionary statement

The Global Outlook includes Exxon Mobil Corporation’s internal estimates of both historical levels and projections of challenging topics such as global energy demand, supply, and trends through 2050 based upon internal data and analyses as well as publicly available information from many external sources including the International Energy Agency. Separate from ExxonMobil’s analysis, we discuss a number of third-party scenarios such as the Intergovernmental Panel on Climate Change Likely Below 2°C and the International Energy Agency scenarios. Third-party scenarios discussed in this report reflect the modeling assumptions and outputs of their respective authors, not ExxonMobil, and their use and inclusion herein is not an endorsement by ExxonMobil of their results, likelihood or probability. Work on the Outlook and report was conducted during 2024 and 2025. The report contains forward-looking statements, including projections, targets, expectations, estimates and assumptions of future behaviors. Actual future conditions and results (including but not limited to energy demand, energy supply, the growth of energy demand and supply, the impact of new technologies, the relative mix of energy across sources, economic sectors and geographic regions, imports and exports of energy, emissions and plans to reduce emissions) could differ materially due to changes in a number of factors, including: economic conditions, the ability to scale new technologies on a cost-effective basis, unexpected technological developments, the development of new supply sources, changes in law or government policy, political events, demographic changes and migration patterns, trade patterns, the development and enforcement of global, regional or national mandates, changes in consumer preferences, war, civil unrest, and other political or security disturbances, including disruption of land or sea transportation routes; decoupling of economies, realignment of global trade and supply chain networks, and disruptions in military alliances and other factors discussed herein and under the heading “Factors Affecting Future Results” in the Investors section of our website at Exxon Mobil Corporation | ExxonMobil

The Outlook was published in August 2025. ExxonMobil assumes no duty to update these statements or materials as of any future date, and neither future distribution of this material nor the continued availability of this material in archive form on our website should be deemed to constitute an update or re-affirmation of this material as of any future date. The Global Outlook is a voluntary disclosure and are not designed to fulfill any U.S., foreign, or third-party required reporting framework. This material is not to be used or reproduced without the express written permission of Exxon Mobil Corporation. All rights reserved.